“`html

Alibaba reported a 5% increase in overall revenues to 247.8 billion yuan ($35 billion) in Q3 2025, but net income fell by approximately 50% amid increased spending on consumer subsidies and data centers. Cloud revenues surged 34% year-over-year, yet the company experienced a negative free cash flow of RMB 21.8 billion. Challenges include regulatory uncertainties and rising competition, putting pressure on margins.

Amazon saw a 13% revenue increase to $180.2 billion in Q3 2025, with AWS revenues climbing 20% to $33 billion. Net income rose 38% to $21.2 billion, significantly exceeding estimates. Amazon struck a $38 billion strategic partnership with OpenAI and projected Q4 revenues between $206 billion and $213 billion, demonstrating strong operational efficiency and growth potential.

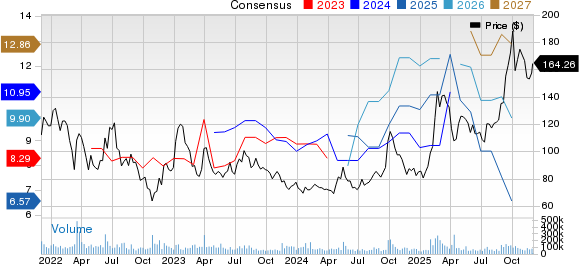

Valuation comparisons show Amazon trading at a forward P/E ratio of 30.08, compared to Alibaba’s 18.63. Despite Alibaba’s stock surge of 42.9% over six months, Amazon’s fundamentals and growth trajectory suggest a more favorable investment outlook, with Zacks ranking Amazon stock as a #2 (Buy) and Alibaba as a #5 (Strong Sell).

“`