“`html

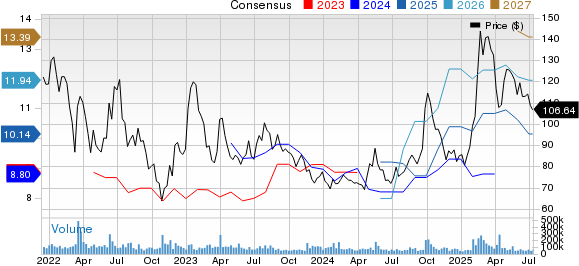

China’s e-commerce giants Alibaba (BABA) and JD.com (JD) are taking distinct approaches to the digital commerce market, which is the largest in the world. Both companies are evolving beyond traditional retail into areas like cloud computing and artificial intelligence (AI). As Alibaba invests RMB 380 billion in AI over three years and reports a projected earnings increase of 12.54% year-over-year for fiscal 2026, JD.com faces challenges with a projected earnings decline of 15.49% for 2025.

Alibaba shows a 25.8% year-to-date share price increase, while JD.com has experienced a 10% decline. Alibaba’s investment in AI infrastructure, partnerships with smartphone manufacturers, and cloud growth highlight its strategic advantage over JD, which struggles with cash outflows from aggressive food delivery expansion and international logistics investments.

Currently, Alibaba trades at a P/E ratio of 10.02x, whereas JD.com is at 7.66x, with Alibaba’s diverse revenue streams and growth prospects justifying its premium. Overall, Alibaba’s tech-driven strategy positions it better for long-term growth, while JD.com’s capital-intensive model poses risks, prompting recommendations to hold Alibaba shares and reconsider JD exposure.

“`