AMD’s Strong Earnings Set the Stage for Nvidia’s Big Reveal

The Q3 earnings season is winding down, with only a handful of S&P 500 companies remaining to report their quarterly results.

Stay informed about all quarterly results: Check out the Zacks Earnings Calendar.

The anticipation is building for Nvidia NVDA, whose results will be released after the market closes on Wednesday. Earlier in the quarter, Advanced Micro Devices AMD announced its quarterly figures, providing insights into AI demand and trends in video gaming.

Here’s what we learned.

AMD Achieves Impressive Data Center Growth

Advanced Micro Devices reported substantial growth, with earnings per share (EPS) increasing by 31% and sales rising by 17%. The company’s gross margin reached 54%, an increase from 47% compared to last year, boosting profitability.

Data Center revenue hit $3.5 billion, marking a quarterly record with an incredible 122% rise from the same period last year. These results highlight the ongoing strong demand for AI, a pattern that has become familiar over recent quarters.

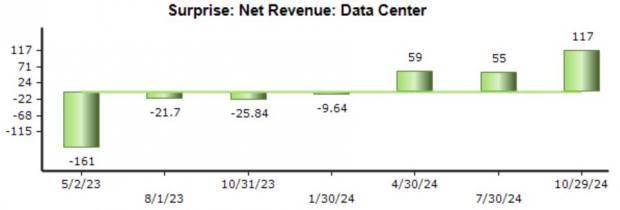

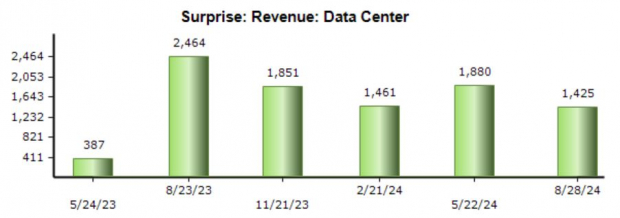

Historically, AMD’s data center results have regularly surpassed consensus expectations, indicating a positive trend as shown below.

Image Source: Zacks Investment Research

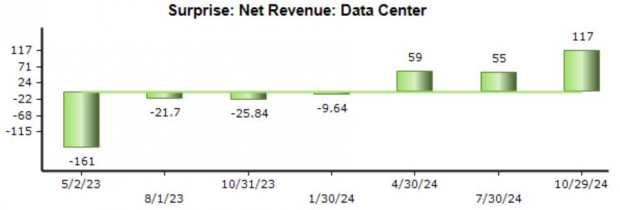

Valuation metrics remain reasonable, with a current forward earnings multiple of 29.4X, contrasting favorably with a 42.3X five-year median and peaks of 106.9X. The current PEG ratio is 1.0X, below historical benchmarks and competitive against the average for the Zacks Computer and Technology sector.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

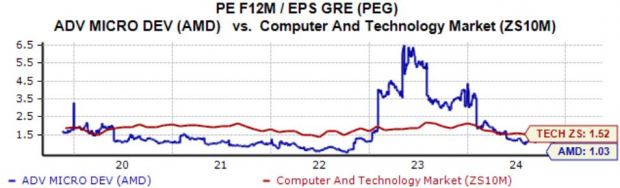

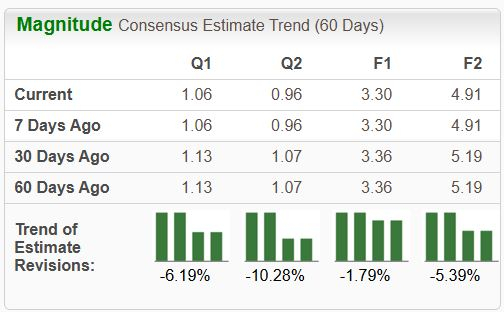

Despite strong Data Center performance, AMD’s stock did not react positively after earnings, as analysts revised earnings expectations downward. The company’s weak sales guidance has contributed to this negative market sentiment.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Investor Focus Turns to Nvidia Guidance

Nvidia’s Data Center results have consistently exceeded expectations in recent quarters, with its most recent report highlighting an impressive $1.4 billion beat, fueled by high demand.

Image Source: Zacks Investment Research

Investors can anticipate another strong performance in Nvidia’s Data Center, with a consensus estimate of $28.9 billion suggesting nearly 100% growth year-over-year. The demand trend indicated by AMD also supports a positive outlook for NVDA.

CEO Jensen Huang expressed optimism following Q2 results, emphasizing robust demand for Hopper and anticipation for Blackwell with the remark, “NVIDIA achieved record revenues as global data centers are modernizing with accelerated computing and generative AI.”

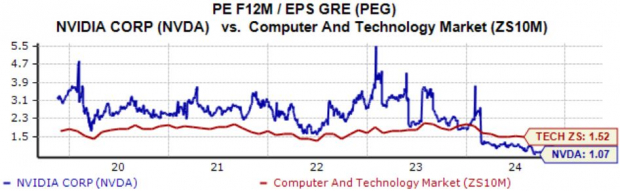

Nvidia’s valuation multiples appear reasonable by comparison, with a current forward earnings multiple of 38.7X, well below the 50.7X five-year median and 106.3X five-year high. Additionally, the PEG ratio stands at 1.1X, again significantly lower than historical values and more favorable than the Zacks Computer & Technology sector average of 1.5X.

Image Source: Zacks Investment Research

Conclusion: Anticipation for Nvidia’s Q3 Results

As Nvidia prepares to announce its Q3 results, investors are keenly interested in how these findings will impact the overall market, especially within the Mag 7 group. AMD’s strong Data Center performance suggests a favorable outlook for Nvidia as well.

While the market didn’t respond favorably to AMD’s results, mainly due to subdued sales forecasts, Nvidia’s guidance is expected to significantly influence post-earnings stock performance. A strong year-over-year growth is anticipated, reinforcing its position as a leader in the AI sector.

7 Best Stocks for the Next 30 Days

Recently released: Experts have identified 7 premier stocks from a current list of 220 Zacks Rank #1 Strong Buys. These stocks are considered “Most Likely for Early Price Pops.”

Since 1988, the full list has consistently outperformed the market by more than 2X, yielding an average gain of +23.7% per year. It’s worth your attention to these selected stocks.

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Read more about AMD vs. Nvidia on Zacks.com here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.