Advanced Micro Devices (AMD) and Semtech (SMTC) are poised for growth in the semiconductor market, which is projected to increase from $631.01 billion in 2025 to $958.93 billion by 2030, at a CAGR of 8.73% during the forecast period. Shipment volumes are also expected to rise from 1.40 trillion units in 2025 to 2.29 trillion units by 2030, demonstrating a CAGR of 10.32%.

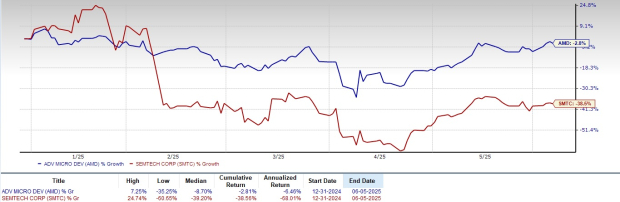

In Q1 2025, AMD reported data center revenues of $3.674 billion, a 57.2% year-over-year increase, while Semtech achieved $51.6 million in data center revenues for Q1 fiscal 2026, marking a 143% year-over-year increase. However, year-to-date stock performance shows AMD and SMTC shares have decreased 2.8% and 38.5%, respectively.

The Zacks Consensus Estimate pegged AMD’s 2025 earnings at $4.02 per share (up 21.45% year-over-year) and Semtech’s fiscal 2026 earnings at $1.66 per share (up 88.64% year-over-year). Currently, Semtech holds a Zacks Rank #2 (Buy), while AMD has a Zacks Rank #3 (Hold).