“`html

Amazon (AMZN) and Shopify (SHOP) showcase distinct strategies in the e-commerce landscape. Amazon reported second-quarter net sales of $167.7 billion, a 13% increase, with operating income rising 31% to $19.2 billion. In contrast, Shopify’s second-quarter revenues reached $2.68 billion, reflecting a 31% growth year-over-year, while gross merchandise volume (GMV) increased to $74.75 billion.

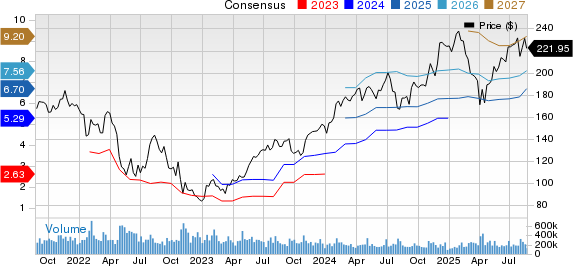

Amazon’s cloud revenue from AWS stood at $30.87 billion, up 18% year-over-year, while its advertising segment generated $15.69 billion with a 23% year-over-year growth. Shopify’s international GMV surged by 42%, highlighting significant international expansion. Despite the high growth expectations reflected in Shopify’s P/E ratio of over 83.64, Amazon’s forward P/E ratio is at 30.61, depicting a more attractive risk-adjusted valuation.

For 2025, Zacks Consensus Estimates suggest Amazon earnings per share (EPS) of $6.7, a 21.16% increase, whereas Shopify’s EPS is pegged at $1.44, an increase of 10.77%. Year-to-date performance shows Amazon up 3.6%, while Shopify has exhibited higher volatility with substantial gains following earnings reports. Both companies currently hold a Zacks Rank of #3 (Hold).

“`