Comparing Apple and Dell: Investment Prospects for 2025

Both Apple (AAPL) and Dell Technologies (DELL) are prominent players in the personal computer (PC) sector. According to IDC, the market is projected to see a year-over-year shipment growth of 2.1% in 2025. By 2029, global PC shipments are expected to reach 422.6 million, growing at a compound annual growth rate (CAGR) of 0.4% between 2025 and 2029. In the commercial sector, shipments are forecasted to grow 4.3% annually to 138 million, ultimately reaching 142.6 million by 2029.

In the U.S., shipment growth is estimated at 1.7%, pushing total shipments to 70.4 million in 2025. Growth for 2026 is anticipated at 1.9%, reaching 71.7 million. The commercial segment is projected to grow 6.3% in 2025 and 1.4% in 2026, while consumer shipments are expected to be flat in 2025 but increase by 1.1% in 2026.

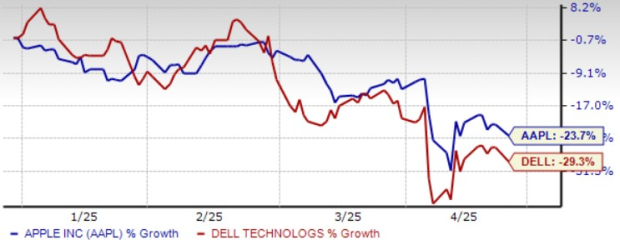

Key catalysts for this growth include rising demand for artificial intelligence (AI)-powered PCs and the impending end-of-service deadline for Microsoft Windows 10 in October 2025. However, challenges such as higher U.S. tariffs, particularly on Chinese imports, and recessionary concerns have had a negative impact on both Apple and Dell. Year-to-date, Apple shares have fallen 23.4%, while Dell has seen a steeper decline of 29.3%.

Analyzing AAPL and DELL Stock Performances

Image Source: Zacks Investment Research

With the current market conditions, the question remains: which stock is a better buy, Apple or Dell Technologies?

The Investment Case for Apple Stock

Apple’s Mac segment has been bolstered by strong demand for its M4, M4 Pro, and M4 Max chips. This March, Apple expanded its Mac lineup with the introduction of a new MacBook Air featuring the M4 chip, which boasts up to 18 hours of battery life and a new 12MP Center Stage camera. Additionally, the new Mac Studio showcases the M4 Max and M3 Ultra chips, with the latter being Apple’s most powerful chip to date, equipped with double Neural Engine cores and Thunderbolt 5 for enhanced connectivity.

This robust product lineup has propelled Apple to gain market share in Q1 2025. As reported by IDC, Apple achieved a market share of 8.7%, up 70 basis points year-over-year, with shipments rising 14.1% to 5.5 million units. Gartner reports a slight increase, with Mac share gaining 20 basis points and a 7% uptick in shipments year-over-year.

Furthermore, the global availability of Apple Intelligence, featuring updates to macOS Sequoia 15.4 across numerous languages—including French, German, Italian, Portuguese, Spanish, Japanese, Korean, and simplified Chinese—supports optimism for Mac’s future prospects.

The Investment Case for Dell Technologies Stock

Dell is capitalizing on AI growth, transitioning from major cloud services to large-scale enterprise deployments and edge computing. The Dell AI Factory integrates DELL’s solutions tailored for AI workloads and collaborates with industry leaders like Meta Platforms, Microsoft, and Hugging Face, alongside NVIDIA. Recent advancements include Dell Pro Max AI PCs, new PowerEdge servers, and the Dell AI Data Platform powered by NVIDIA.

In the fourth quarter of fiscal 2025, the Client Solutions Group generated revenues of $11.88 billion, reflecting a 1% year-over-year increase. Commercial Client revenues rose 5% to $10 billion, whereas Consumer revenues dropped 12% to $1.89 billion.

According to IDC, DELL’s market share in Q1 2025 was 15.1%, down 30 basis points year-over-year, with shipments growing 3% to 9.6 million. Gartner noted DELL shares reduced by 40 basis points, while shipments increased by 2.1% year-over-year.

Earnings Estimates for DELL Remain Stable, AAPL Faces Decline

The Zacks Consensus Estimate for DELL’s fiscal 2026 earnings remains at $8.97 per share, unchanged over the past 60 days, marking a 10.2% projected increase from fiscal 2025.

Dell Technologies Inc. Price and Consensus

Dell Technologies Inc. price-consensus-chart | Dell Technologies Inc. Quote

The earnings consensus for AAPL has seen a decline of 0.6% to $7.18 per share over the last 60 days. This suggests a growth rate of 6.37% from fiscal 2024 earnings.

Apple Inc. Price and Consensus

Apple Inc. price-consensus-chart | Apple Inc. Quote

Both DELL and AAPL have successfully exceeded the Zacks Consensus Estimate in all four of their recent quarters. Notably, Dell has demonstrated a stronger average surprise of 5.13%, compared to Apple’s surprise of 4.39%, indicating more consistent earnings performance. (For the latest EPS estimates and surprises, visit Zacks’ Earnings Calendar.)

Valuation Comparison: DELL is More Affordable Than AAPL

From a valuation perspective, Dell Technologies presents a more attractive option compared to Apple. DELL holds a Value Score of B, while Apple carries a Value Score of D, indicating potentially inflated valuation. Dell shares trade at a forward 12-month Price/Sales ratio of 0.57X, significantly lower than Apple’s 7.13X.

Comparative Valuation of DELL and AAPL

Image Source: Zacks Investment Research

Conclusion

Dell Technologies boasts a strong AI-focused PC product line and a solid network of partnerships, along with a favorable valuation. While both Apple and Dell share a Zacks Rank #3 (Hold), Dell stands out as the stronger investment choice due to its promising outlook.

Zacks Research Identifies Top Stock Poised for Major Gains

Investment Insight from Zacks’ Chief Research Officer

Experts at Zacks Investment Research have revealed five stocks with high potential to increase by 100% or more within the next few months. Among these, Sheraz Mian, the Director of Research, has singled out one stock expected to see the most significant rise.

This standout stock belongs to a leading financial firm known for its innovation. With a rapidly expanding customer base of over 50 million and a strong lineup of cutting-edge solutions, this stock is positioned for substantial growth. Although not all stock picks from Zacks have performed well, this stock has the potential to significantly outperform previous selections like Nano-X Imaging, which surged by 129.6% in just over nine months.

Free: Discover Our Top Stock and 4 Additional Options

For investors seeking the latest recommendations from Zacks, you can now access “7 Best Stocks for the Next 30 Days” at no cost. Click to download this free report today.

Want the latest recommendations from Zacks Investment Research? Download now.

For detailed analysis, you can also take a look at:

- Apple Inc. (AAPL): Free Stock Analysis Report

- Dell Technologies Inc. (DELL): Free Stock Analysis Report

Read more about the comparison between Apple and Dell Technologies here.

For further information, visit Zacks Investment Research.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.