AppLovin Corporation (APP) and Arm Holdings plc (ARM) are leveraging artificial intelligence to enhance their operations, with significant impacts on their market performance and prospects. AppLovin has seen a 77% year-over-year increase in revenues in Q2 2025, equating to an estimated $10 billion annual run rate in advertising spend, driven by its AI engine, Axon 2, launched in Q2 2023. Meanwhile, ARM is becoming a crucial player in AI hardware, but faces challenges from rising competition, particularly from the open-source RISC-V architecture in China.

AppLovin’s impressive growth metrics reflect strong market demand and operational efficiency, with an adjusted EBITDA surge of 99% year-over-year. By contrast, ARM anticipates only 18% sales growth and a modest 3% increase in EPS due to its reliance on the sluggish Chinese market. The potential adoption of RISC-V technology could hinder ARM’s growth prospects significantly.

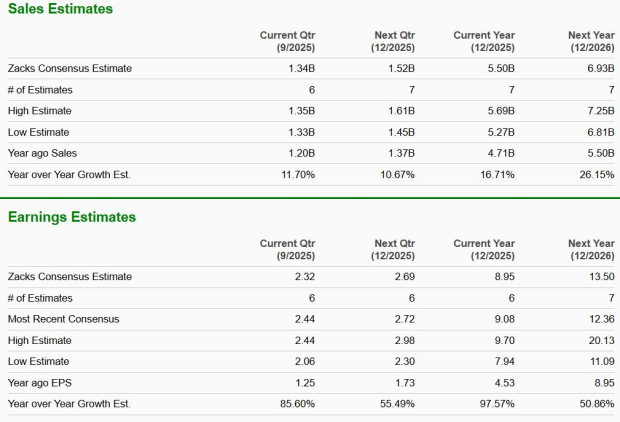

Current estimates suggest APP will achieve a 17% year-over-year sales increase and a 98% rise in earnings, while ARM projects slower growth at 18% in sales. In terms of valuation, APP’s forward P/E is at 39.36, reflecting a robust earnings outlook compared to ARM’s 73.32. This positions AppLovin as a more attractive investment option for those seeking growth in the AI-driven technology sector.