Bristol-Myers Squibb’s Stock Performance and Future Outlook

Bristol-Myers Squibb Company (BMY), based in Princeton, New Jersey, specializes in discovering, developing, licensing, manufacturing, and marketing biopharmaceutical products. With a market capitalization of $121.4 billion, the company operates in multiple healthcare sectors including oncology, hematology, immunology, cardiovascular, and neuroscience.

Company Classification and Strengths

Classified as a “large-cap stock,” BMY’s market cap clearly exceeds the $10 billion threshold. This classification highlights the company’s significant size, influence, and standing within the pharmaceutical industry. Key strengths include a robust research and development pipeline, successful drugs such as OPDIVO and Eliquis, and strategic acquisitions that enhance its product range. By leveraging strong patent protections and expertise in biologics and cell therapy, BMY positions itself for continued growth and innovation.

Recent Stock Performance

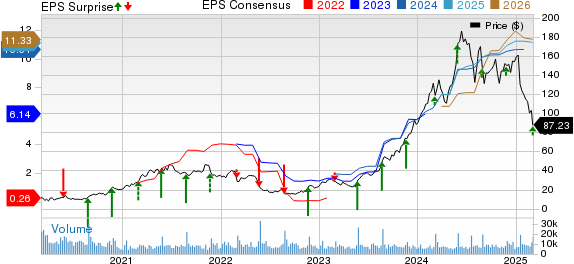

Currently, BMY shares are trading 2.1% below their 52-week high of $61.10, reached on January 27. Over the past three months, the stock has increased by 1.7%, outperforming the broader Dow Jones Industrial Average (DOWI), which has dipped by 3.9% during the same timeframe.

In terms of long-term performance, BMY shares have rallied by 15.4% over the past year, surpassing DOWI’s 11.5% return. Year-to-date, BMY shares are up 5.8%, while DOWI shows a meager 1.1% increase.

Supporting a bullish outlook, BMY has remained above its 200-day moving average since mid-July 2024 and has consistently stayed above its 50-day moving average since late February.

Q4 Earnings Report and Guidance

On February 6, BMY’s stock fell by 3.8% following its Q4 earnings report. Despite an adjusted EPS of $1.67 and revenues of $12.3 billion—both better than expected—revenue growth of 7.5% year-over-year was offset by declines in legacy portfolio revenues. This contrast was primarily due to strong sales from its growth portfolio and Eliquis.

The disappointment largely stemmed from BMY’s 2025 guidance, which was lower than market expectations, predicting adjusted EPS between $6.55 and $6.85 and total revenue nearing $45.5 billion. The potential nearly $500 million negative impact from foreign exchange fluctuations also played a role.

While BMY’s 14.4% gain over the past year exceeds Amgen Inc.’s (AMGN), which saw a 21.5% rise, BMY has lagged AMGN on a year-to-date basis.

Analyst Outlook

In light of BMY’s recent performance, analysts remain moderately optimistic about its future. The stock holds a consensus rating of “Moderate Buy” from 25 analysts, with a mean price target of $59.90, indicating a slight premium relative to current trading levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.