**Capital One Financial Corporation (COF) and American Express Company (AXP) are both prominent players in the consumer finance sector, primarily generating revenue through credit cards. Despite different operating models, with AmEx utilizing a closed-loop network and Capital One using open-loop access, both companies are investing heavily in customer engagement and reward programs.**

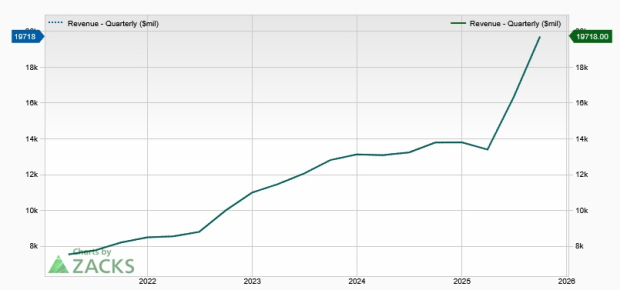

In May 2025, Capital One made a strategic acquisition of Discover Financial Services for $35.3 billion, positioning the company as the largest U.S. credit card issuer. This move is anticipated to expand its payment network capabilities significantly. As of September 30, 2025, COF reported $51.5 billion in total debt and $55.3 billion in cash. Its revenue is projected to reach $53.26 billion for 2025, showcasing a year-over-year growth of 36.2%. Conversely, American Express expects its 2025 revenues to grow by 9-10%, totaling approximately $72.11 billion.

Recent stock performance indicates investor optimism, with COF shares gaining 21.7% and AXP shares rising by 18.4% over the past three months. Currently, Capital One trades at a forward price-to-earnings ratio of 12.81, notably lower than AmEx’s 21.77, suggesting a more attractive valuation for potential investors. Both companies hold a Zacks Rank of #3 (Hold), reflecting their comparable market positions.