Intel Corporation (INTC) and Qualcomm Incorporated (QCOM) are reinvigorating their semiconductor strategies, emphasizing AI and connectivity. Intel is shifting towards data-centric industries, notably autonomous driving and AI, aiming to ship over 100 million AI PCs by the end of 2025. In contrast, Qualcomm will focus on 5G and connectivity solutions, tracking an 11.8% revenue growth forecast for fiscal 2025, while Intel faces a projected 4.3% decline.

As of now, Intel’s shares trade at a price/sales ratio of 1.97, compared to Qualcomm’s 3.93, rendering Intel potentially more appealing from a valuation standpoint. Over the past year, Intel’s stock has dropped by 32%, while Qualcomm has decreased by 24.4%. Despite this, Qualcomm holds a better Zacks Rank (#3 Hold) over Intel’s #4 Sell, indicating a stronger market position for future growth.

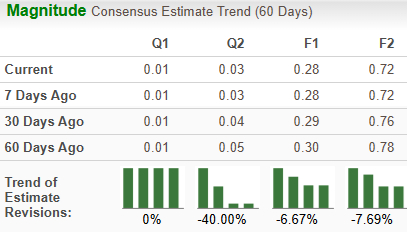

Key estimates indicate that while Qualcomm expects a 14.6% growth in earnings per share (EPS), Intel’s EPS estimates have been trending downward. With both companies looking to enhance earnings by 2025, Qualcomm appears more favorably positioned amidst increasing competition in the semiconductor industry.