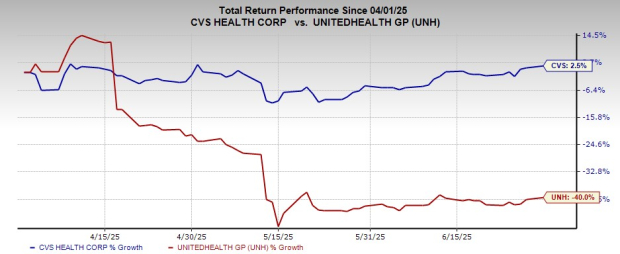

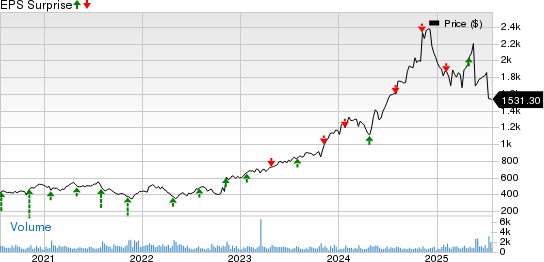

CVS Health and UnitedHealth reported contrasting first-quarter results, with CVS showing strong growth across all segments and raising its full-year EPS guidance. In contrast, UnitedHealth fell short of both earnings and revenue expectations, largely due to escalated medical costs and challenges within the Medicare funding landscape, leading to a significant reduction in its 2025 EPS outlook. Both companies are set to release their second-quarter 2025 results next week, with CVS shares gaining 2.5% in the second quarter compared to a 40% decline in UnitedHealth’s shares.

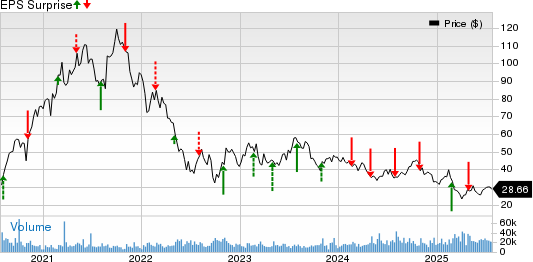

For the first quarter, CVS reported a medical benefit ratio of 87.3%, down from 90.4% year-over-year, while UnitedHealth faced a rising medical care ratio of 84.8%, up from 84.3% in 2024. UnitedHealth has now lowered its 2025 adjusted earnings guidance to between $26.00 and $26.50 per share, markedly down from earlier estimates of around $29.50 to $30.00. In comparing Q2 EPS projections, CVS is expected to see a 19.7% year-over-year drop, while UnitedHealth faces a steeper decline of 28.8%.

CVS is currently valued at a forward price-to-earnings ratio of 8.88X, below its five-year median of 9.55X, while UnitedHealth stands at 11.98X, below a five-year median of 19.20X. This suggests CVS is more attractively valued relative to its historical average compared to UnitedHealth.