Investors are turning their attention to Chevron Corporation (CVX) and Suncor Energy (SU) as both companies have outlined significant operational and capital plans for 2026. Chevron expects to generate an additional $12.5 billion in annual free cash flow by that year, driven by major projects like the Tengizchevroil expansion and the Permian Basin reaching a milestone of 1 million barrels of oil equivalent per day. In contrast, Suncor’s stability is bolstered by a low corporate decline rate and record high refinery utilization, which has averaged 101% to 102%.

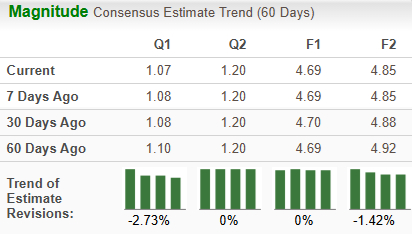

Year-to-date, Suncor’s stock has increased by 24.2%, while Chevron’s has only grown by 4.1%. Valuation comparisons also show Suncor trading at approximately 16 times forward earnings, compared to Chevron’s 19 times. Recent earnings estimates have favored Suncor, with its estimates remaining stable, while Chevron’s have declined due to integration uncertainties and capital spending concerns.

As of now, both companies hold a Zacks Rank #3 (Hold), but Suncor appears to have an edge in the near-term due to its operational reliability and capital return strategies, which include plans to return nearly 100% of excess funds to shareholders. Investors seeking value and stability may find Suncor more appealing, while Chevron remains a reliable option for those prioritizing long-term growth and diversification.