“`html

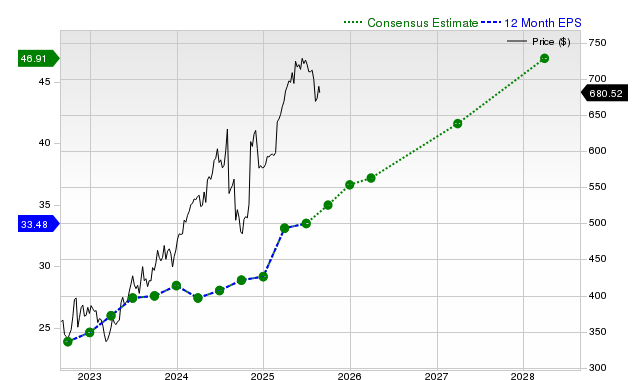

Dell Technologies (DELL) and Applied Digital (APLD) are key players in the AI Infrastructure market, which was valued at $87.6 billion in 2025 and is projected to grow to $197.64 billion by 2030, achieving a 17.71% CAGR. Dell has raised its full-year AI server shipment forecast from $15 billion to $20 billion after reporting $8.2 billion in AI server shipments in Q2 of fiscal 2026, alongside an AI backlog of $11.7 billion.

In Q4 of fiscal 2025, APLD secured 15-year lease agreements with CoreWeave to deliver 250 megawatts at its Polaris Forge 1 campus in North Dakota, anticipated to generate approximately $7 billion in revenue. APLD is also set to construct Polaris Forge 2, a $3 billion, 280MW AI factory, scheduled for completion by early 2027.

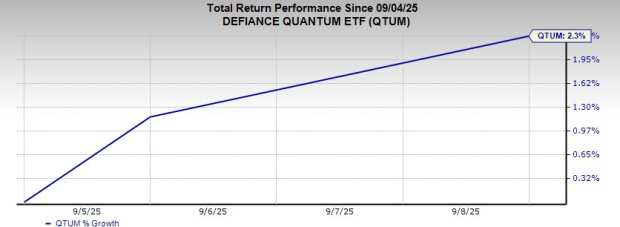

Year-to-date performance has seen APLD stocks rise by 122.2%, compared to an 8% increase for DELL. Despite a cheaper valuation for DELL (Price/Sales at 0.76X) relative to APLD (14.46X), challenges such as weaker demand for traditional servers and declining consumer PC revenue persist for DELL, while APLD’s valuation raises investment concerns due to ongoing losses.

“`