Key Points

-

Ford’s trailing-12-month dividend yield is approximately 4.5%, while Pfizer’s is around 6.9%.

-

Ford has faced challenges in 2025, with $2.4 billion paid in dividends amid $2.8 billion in profits.

-

Pfizer has paid $7.3 billion in dividends, generating $9.4 billion in net income but only $4.6 billion in free cash flow.

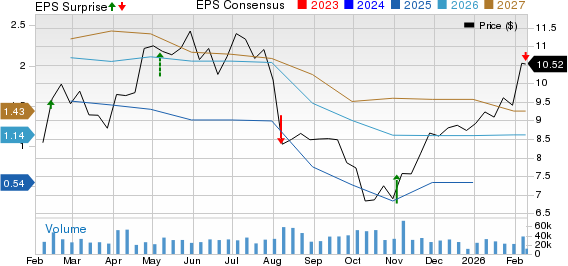

Ford Motor Company (NYSE: F) and Pfizer (NYSE: PFE) are notable dividend stocks, with Ford yielding 4.5% and Pfizer yielding 6.9%. Ford has distributed about $2.4 billion in dividends this year from $2.8 billion in profits, while Pfizer has paid $7.3 billion in dividends against $9.4 billion in income, but only generated $4.6 billion in free cash flow.

Despite Ford’s inconsistent dividend history, it is expected to generate between $2 billion to $3 billion in free cash flow in Q4 2025 and is pivoting towards profitable hybrid vehicle production. Meanwhile, Pfizer is projected to improve its free cash flow but has issued guidance below analyst expectations due to declining revenue from its COVID-19 products.