“`html

Energy Fuels Inc. (UUUU) and Cameco Corporation (CCJ), key players in the uranium industry, are navigating fluctuating uranium prices. Currently, uranium prices have decreased to $77 per pound, down 3% year-over-year from $84, which was the highest in 14 months. This trend coincides with the U.S. Geological Survey’s inclusion of uranium on its 2025 Critical Minerals List, highlighting its importance for national security.

In Q3 2025, Energy Fuels sold 240,000 pounds of uranium at an average price of $72.38 per pound, generating revenues of $17.4 million—a 337.6% year-over-year increase. The company reported total working capital of $298.5 million and plans to mine 55,000–80,000 tons of ore containing 875,000–1,435,000 pounds of uranium for 2025. Conversely, Cameco’s Q3 production rose 2% to 4.4 million pounds, but the sales volume fell by 16%. Total revenues for Cameco dropped by 14.7% year-over-year to CAD 615 million ($446 million).

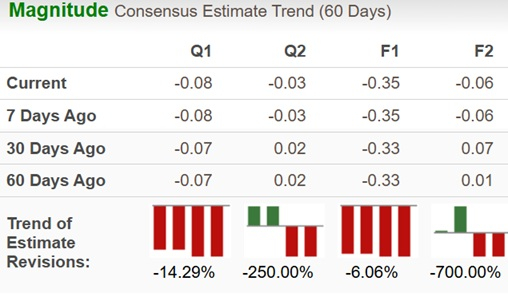

For 2025, Cameco’s uranium deliveries are projected at 32–34 million pounds, an increase from the previous estimate of 31–34 million pounds. In contrast, Energy Fuels is expected to face a revenue drop of 39.8%, forecasting a loss of 35 cents per share. Despite these challenges, Energy Fuels has seen substantial stock price growth of 157.5% this year, compared to Cameco’s 59.6% increase. Both companies are reassessing their production capacities and market strategies.

“`