“`html

The cybersecurity sector is witnessing significant investor interest, driven by escalating digital threats. Prominent players include Fortinet (FTNT), known for its extensive deployment of firewalls, and CrowdStrike (CRWD), a leader in endpoint protection with its AI-native Falcon platform. Both companies are heavily investing in AI capabilities to enhance their security offerings.

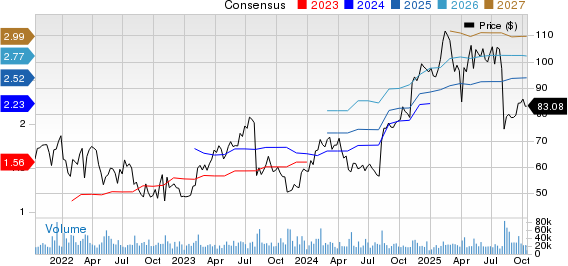

In the second quarter of 2025, Fortinet reported a 14% year-over-year growth in billings and a record non-GAAP operating margin of 34%, raising its full-year billings outlook. In contrast, CrowdStrike achieved $221 million in net new Annual Recurring Revenue (ARR) during its second quarter of fiscal 2026, with total revenues reaching $1.17 billion, marking a 21% year-over-year increase. CrowdStrike’s strong performance is attributed to its partnerships with AWS, Intel, and others, along with a growing customer base exceeding 1,000 Falcon Flex clients.

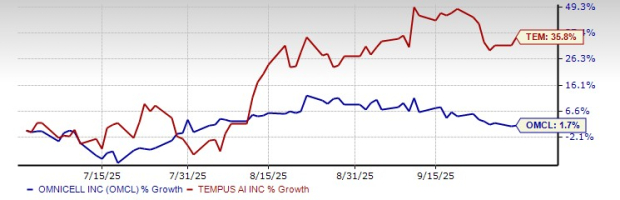

Valuation also varies significantly, with Fortinet trading at a forward sales multiple of 8.68X compared to CrowdStrike’s 22.33X. Despite a 12.1% stock decline for Fortinet year-to-date, CrowdStrike has gained 42.9%, reflecting its superior growth trajectory and strategic advantages in AI-driven security. Investors may prefer CrowdStrike for its robust growth and market leadership, while Fortinet may require a more cautious approach as it navigates to higher-growth segments.

“`