General Mills Faces Stock Challenges Despite Strong Q2 Performance

Minneapolis, Minnesota-based General Mills, Inc. (GIS) stands as a significant player in the global food manufacturing sector, boasting a market cap of nearly $34.4 billion. The company primarily offers a diverse range of products, including ready-to-eat cereals, convenient meals, snacks—such as grain, fruit, and savory varieties, nutrition bars, and frozen options—yogurt, super-premium ice creams, and baking mixes and ingredients.

GIS: A Large-Cap Stock with Strong Brand Loyalty

Designated as a “large-cap stock,” General Mills thrives due to strong brand equity, featuring logos like Cheerios, Häagen-Dazs, Nature Valley, and Blue Buffalo, which foster customer loyalty and stable demand. The company’s distribution strategy is a mix of retail and e-commerce, enhancing its market presence and adaptability. Furthermore, a commitment to innovation, cost efficiency, and strategic acquisitions help fortify General Mills’ competitive advantage.

Active Investor: FREE newsletter going behind the headlines on the hottest stocks to uncover new trade ideas

Stock Performance Overview

Recently, shares of General Mills have dropped 20.9% from their 52-week high of $75.90, achieved on September 10. Over the past three months, GIS’s stock has fallen 9.2%, compared to the broader Nasdaq Composite’s ($NASX) 11.3% decline within the same period.

Year-to-date, GIS stock is down 5.9%, outperforming NASX’s decline of 8.6% similarly assessed. However, looking at a longer timeline, the stock has experienced an 8.7% decrease over the past 52 weeks, considerably lagging behind NASX, which posted an 8.5% gain.

Moving Averages and Recent Declines

In a sign of weak momentum, GIS has been trading below its 200-day moving average since early November and has consistently remained below its 50-day moving average since early October 2024, albeit with some volatility.

Q2 Results and Future Outlook

Despite a decline of 3.1% on December 18, GIS reported stronger-than-expected Q2 outcomes, with adjusted earnings of $1.40 per share and revenues of $5.2 billion, both exceeding Wall Street’s expectations. Revenue grew nearly 2% year-over-year, and adjusted earnings increased by 12%, driven primarily by enhanced adjusted operating profit and robust sales in North America’s food service sector. The company also improved its gross margin by 250 basis points, mainly due to effective Holistic Margin Management (HMM).

However, General Mills’ outlook for fiscal year 2025 disappointed some investors. They pointed out that certain timing benefits in the first half could lead to reversals in the second half of the fiscal year, prompting a downward revision of their adjusted operating profit and EPS guidance. The new forecast anticipates an adjusted operating profit decline of between 4% and 2% in constant currency, as well as a decrease in adjusted EPS ranging from 3% to 1% in constant currency.

In contrast, GIS has fared better than its competitor, The Campbell’s Company (CPB), which has seen a 10.3% drop over the past year and a 7.9% decline year-to-date.

Analyst Sentiment and Future Potential

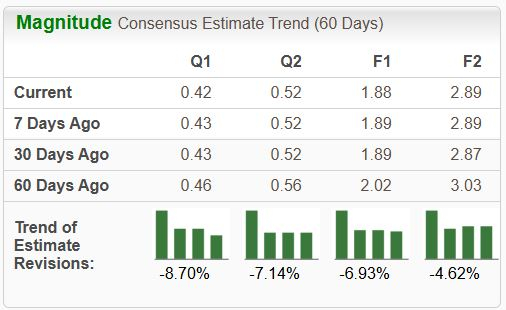

Even with its recent challenges, analysts maintain a moderately optimistic outlook for GIS. The stock carries a consensus rating of “Moderate Buy” from 18 analysts, with a mean price target of $66.06, suggesting a modest potential upside of about 10% from its current level.

On the date of publication,

Neharika Jain

did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy

here.

More news from Barchart

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.