Investors Eye Ford and General Motors as Q4 Earnings Approach

As the fourth-quarter 2024 earnings season for the auto sector begins tomorrow, investors are focusing on General Motors GM and Ford F to identify the more favorable investment opportunity. GM is scheduled to announce its results before the opening bell tomorrow, while Ford will follow on February 5 after market close.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Earnings Expectations for Ford and General Motors

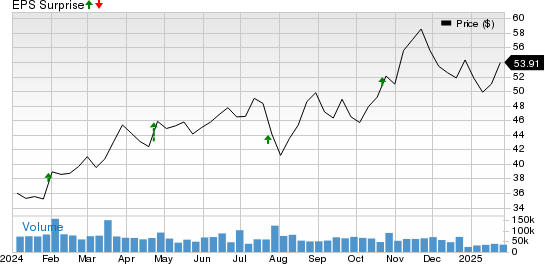

The Zacks Consensus Estimate forecasts GM’s earnings at $1.75 per share, with revenues expected to reach $43.8 billion. Notably, the company has exceeded EPS projections for the past four quarters by an average of 17.54%.

General Motors Company Price and EPS Surprise

General Motors Company price-eps-surprise | General Motors Company Quote

In comparison, the consensus for Ford’s EPS and sales stands at 34 cents and $43.6 billion, respectively. Ford has shown a mixed results history; it has beaten estimates in two of the past four quarters, missed once, and matched the others.

Ford Motor Company Price and EPS Surprise

Ford Motor Company price-eps-surprise | Ford Motor Company Quote

Our analysis suggests that GM is likely to report an earnings beat this quarter, while Ford may not fare as well.

The likelihood of an earnings surprise increases when a company has a positive Earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold). General Motors holds a Zacks Rank #2 along with an Earnings ESP of +2.85%, while Ford has a Zacks Rank #4 (Sell) and an Earnings ESP of 0.00%.

Key Predictions for Q4 Earnings

Following strong performance in the first three quarters of 2024, General Motors raised its full-year outlook. The company anticipates fourth-quarter adjusted EBIT to exceed $2.3 billion, marking a 33% increase year-over-year.

Strength in the North American market is expected to contribute positively to GM’s results, with fourth-quarter revenues and operating income anticipated to rise 2% and 43%, respectively, within that region. However, the company’s GMI segment, excluding its joint venture in China, is projected to experience significant declines, with expected revenue and operating income contractions of 10.6% and 73%. Furthermore, GM estimates it may incur up to $5 billion in charges and write-downs this quarter due to restructuring in China.

Ford recently lowered its EBIT forecast for full-year 2024 amid rising warranty costs and inflation challenges linked to its joint venture in Turkey. The automaker now projects EBIT to be around $10 billion, aligning with the lower end of prior estimates of $10-$12 billion. For the fourth quarter, Ford’s revenues from its Blue and Model e segments are expected to decline by 2% and 23%, totaling $25.7 billion and $1.2 billion, respectively, as pricing pressures and increasing investments in EVs lead to significant losses in the Model e segment.

Despite these challenges, the Ford Pro segment is thriving, benefiting from strong demand and new product launches, including the Super Duty. The company expects fourth-quarter revenues from this segment to rise by 7% to $16.4 billion. Moreover, Ford anticipates realizing a $700 million gain in special items during this quarter due to pension adjustments.

Why General Motors Might Be the Better Investment

General Motors continues to lead the auto market in the U.S., having sold 2.7 million vehicles in 2024, and holds the second position in U.S. battery electric vehicle (BEV) sales, trailing only Tesla. GM’s diverse range of EVs, including the Chevy Equinox EV, Cadillac Lyriq, and GMC Hummer EV, has solidified its place as the second largest EV seller in the country. The company’s partnerships with Vianode, Lithium Americas, LG Chemical, POSCO Chemical, and Livent enhance its EV supply chain, aligning with its electrification strategy.

Importantly, GM plans to achieve profitability in its EV segment on an EBIT basis by the end of 2024 while aiming to reduce fixed costs by $2 billion. The company’s strong balance sheet and stock buyback initiatives further support its investment appeal. Although competition and pricing pressures in China are concerning, GM expects that restructuring efforts will yield positive changes.

Ford’s Position in the Market

Ford was the third best-selling automaker in the U.S. in 2024, following GM and Toyota, with sales exceeding 2 million vehicles. Its strong lineup, including F-series trucks and a variety of SUVs, will expand with new model releases like the Maverick and Bronco. The continued growth of Ford’s Pro business, focused on vehicles, software, and services, is noteworthy. The company’s software strategy is predicted to be a key driver of future growth.

Moreover, Ford boasts an attractive dividend yield exceeding 5%. However, the company faces significant short-term challenges. Losses from its EV business are likely to widen, impacting overall performance. Additionally, high warranty costs arising from quality issues with older models have created financial strain, which is expected to persist into 2025.

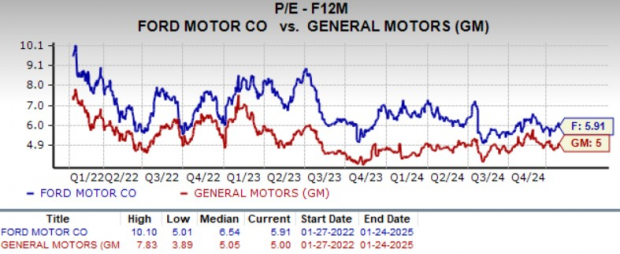

Valuation Analysis: Ford vs. GM

Currently, GM shares trade at a Price/Earnings ratio of 5X forward earnings, below its three-year high of 7.83X. Ford also trades at a discount to its three-year high at 5.91X forward earnings, but GM appears to present a more attractive valuation at this time.

Image Source: Zacks Investment Research

Conclusion: Which Automaker to Watch

If investors must choose between these two automotive giants, General Motors currently stands out as the better option. Its leadership in the U.S. market, strong earnings performance, and advances toward EV profitability give it an edge over Ford, which grapples with increasing EV losses and warranty costs. In terms of valuation, GM also holds a favorable position. Considering these factors, investing in General Motors appears more prudent at this time.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has just released the 5 stocks with the greatest potential for gaining +100% or more in the months ahead. Among these, Director of Research Sheraz Mian identifies one stock poised to see the highest growth.

This top pick is from a leading financial firm with a rapidly expanding customer base of over 50 million and a suite of innovative solutions, making it set for substantial gains. While not every selection may succeed, this stock could significantly outperform past Zacks’ Stocks Set to Double like Nano-X Imaging, which rose by +129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

Interested in the latest recommendations from Zacks Investment Research? Today, download the report on the 7 Best Stocks for the Next 30 Days for free.

Ford Motor Company (F): Free Stock Analysis Report

General Motors Company (GM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.