Hims & Hers Health, Inc. (HIMS) and Teladoc Health, Inc. (TDOC) are at the forefront of expanding virtual healthcare. HIMS operates a subscription-based telehealth platform providing users with online consultations and recurring prescriptions, while TDOC offers integrated virtual care services, including medical visits and therapy through BetterHelp.

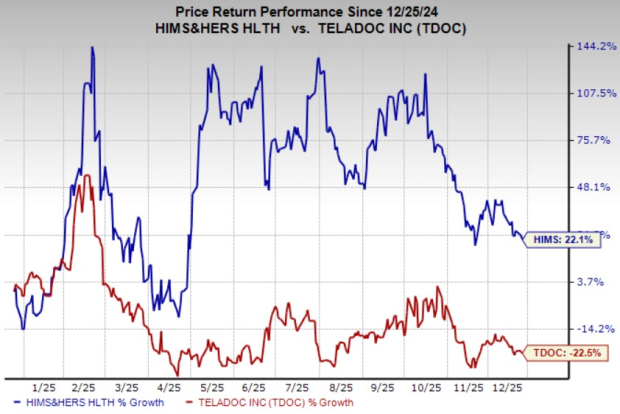

Over the past three months, HIMS has seen a decline of 37.4%, compared to TDOC’s drop of 9.7%. However, in the past year, HIMS has climbed 22.1%, while TDOC has suffered a loss of 22.5%. HIMS currently has a forward price-to-sales (P/S) ratio of 2.9, above its recent median of 2.6, while TDOC’s ratio is at 0.5, lower than its median of 0.7.

Analysts project HIMS’ earnings per share (EPS) to improve by 77.8% in 2025, whereas TDOC is expected to show a 79.7% improvement in its loss per share for the same period. Current short-term price targets suggest HIMS could rise by 31.9% to $45.92 and TDOC by 27.3% to $9.18.