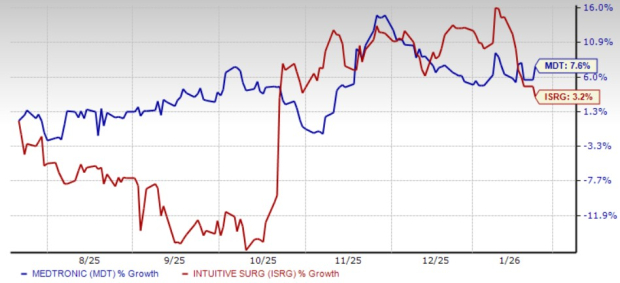

Intuitive Surgical (ISRG) and Medtronic (MDT) showcase contrasting strategies in the MedTech industry, with ISRG focusing exclusively on robotic-assisted surgery while MDT operates as a diversified medical technology conglomerate. Over the past six months, ISRG shares gained 3.2%, while MDT shares rose by 7.6%.

ISRG generates approximately 85% of its revenues from recurring sources, and experienced a 19% growth in procedures translating to similar revenue expansion. Recent operating margins for ISRG hovered around 39%, supported by high utilization and strong free cash flow. In contrast, MDT is facing macroeconomic challenges impacting procedural volumes, and is expecting $185 million in tariff-related costs for fiscal 2026. Both companies’ forward price-to-earnings ratios stand at 54.4 for ISRG and 16.4 for MDT, indicating ISRG’s premium valuation despite strong growth prospects.

Experts suggest ISRG offers a superior long-term investment outlook due to its focused approach and high-margin model. MDT’s diversified strategies, while formidable, dilute its momentum in the robotic space, placing ISRG in a more favorable position for investors seeking robust growth potential.