The global medical device market is expected to grow at a CAGR of 6.8% from 2025 to 2032, with significant contributions from major companies Hologic (HOLX) and Stryker (SYK). Hologic currently has a market capitalization of $16.71 billion and is in the process of a buyout by Blackstone and TPG, aimed at enhancing its delivery of medical technologies. Stryker, with a market cap of $139.1 billion, offers products in approximately 75 countries and anticipates 10% organic sales growth for its medical business this year.

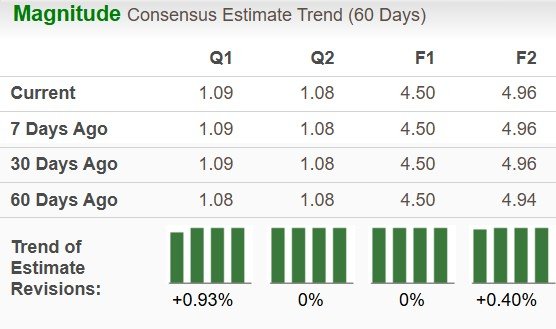

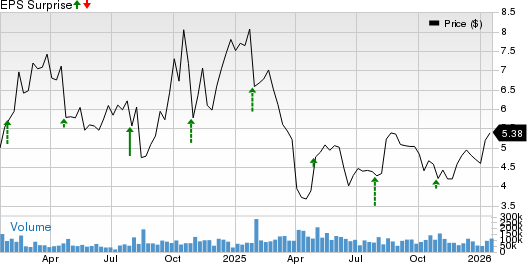

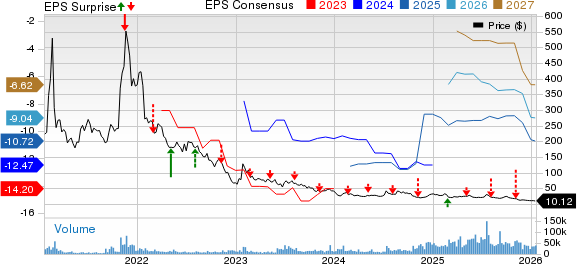

Hologic’s upcoming earnings report is projected to show a 5.8% year-over-year earnings increase to $1.09 per share, driven by strong U.S. molecular diagnostics sales. In contrast, Stryker’s fourth-quarter earnings are expected to grow by 9.5% year-over-year to $4.39 per share, bolstered by solid demand for capital products in the U.S. market. Both companies are positioned for growth, with Hologic benefiting from innovations like its new diagnostic assays and Stryker capitalizing on successful product launches and acquisitions.

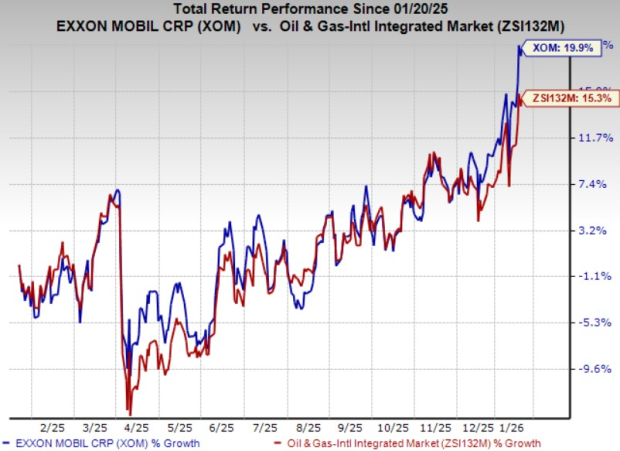

Over the past six months, Hologic shares have increased by 17.7%, while Stryker’s share price has decreased by 6.1%. Hologic’s forward two-year price-to-earnings ratio stands at 16.15, significantly lower than Stryker’s 24.14, suggesting that Hologic may hold an edge in terms of valuation as both firms continue to solidify their market positions.