“`html

Micron Technology, Inc. (MU) and NVIDIA Corporation (NVDA) are critical players in the artificial intelligence (AI) infrastructure sector. Micron’s revenue for Q3 fiscal 2025 increased by 37% year-over-year, with non-GAAP EPS rising 208%. NVIDIA’s data center revenues surged 56% in Q2 fiscal 2026 to $41.1 billion, bolstered by increasing demand for AI-capable GPUs.

Micron is expanding its market presence with advanced memory solutions, including high-bandwidth memory (HBM) products, and anticipates a 33.9% revenue growth for fiscal 2026. Conversely, NVIDIA is focusing on AI infrastructure with newer GPU platforms, forecasting a revenue increase of 55.5% for the same period. Additionally, NVIDIA secured approval to sell its H20 chips in China, possibly enhancing its market share.

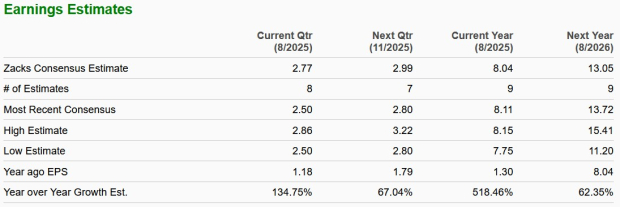

As of now, Micron’s forward price-to-sales (P/S) ratio is significantly lower at 3.58 compared to NVIDIA’s 17.4, making Micron a more attractive investment option due to its higher earnings growth projection and current Zacks Rank #1 (Strong Buy), versus NVIDIA’s Zacks Rank #3 (Hold).

“`