“`html

The Mosaic Company (MOS) and Nutrien Ltd. (NTR) are significant players in the global fertilizer market, with strong demand driven by favorable agricultural conditions. For the second quarter of 2025, MOS reported an operating cash flow of $610 million and free cash flow of $305 million, whereas NTR had cash and cash equivalents of $1.387 billion, a 38% increase year-over-year, and cash provided by operating activities surged 40% to $2.538 billion.

In terms of sales projections, the Zacks Consensus Estimate predicts MOS will see a 16.8% year-over-year increase in 2025 sales and a 60.1% rise in EPS. In comparison, NTR’s estimates reflect a more modest sales increase of 3.4% and a 26.2% rise in EPS. Nutrien’s potash sales volumes reached record highs, driving a revised sales volume forecast to 13.9-14.5 million tons.

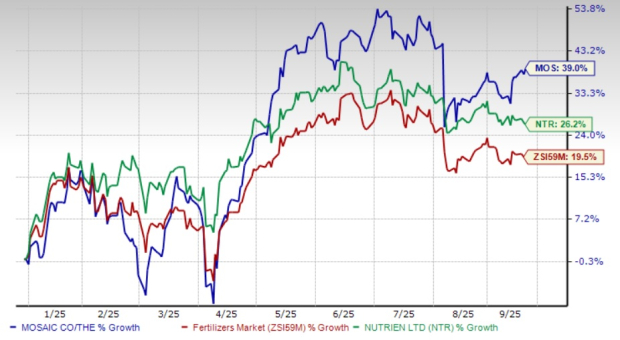

Year-to-date, MOS stock has risen 39%, while NTR’s stock rose 26.2%. Currently, MOS is trading at a forward 12-month earnings multiple of 11.76, compared to NTR’s 12.79. Both companies are projected to benefit from ongoing fertilizer demand and improved pricing, but MOS appears to have a slight edge due to its higher growth projections and more attractive valuation.

“`