“`html

Microsoft reported first-quarter fiscal 2026 revenues of $77.7 billion, an 18% year-over-year increase, with a notable performance from its cloud segment generating $30.89 billion. In contrast, ServiceNow achieved third-quarter subscription revenues of $3.3 billion, reflecting a growth of 21.5% year-over-year, prompting the company to raise its 2025 revenue guidance. Microsoft has collaborations with OpenAI, while ServiceNow is focusing on AI workflow automation.

Microsoft’s investment costs led to a net income loss of $3.1 billion and a diluted earnings per share of 41 cents. Conversely, ServiceNow has reported an operating margin of 33.5%, exceeding guidance projections. ServiceNow’s focus is illustrated by an increase in its current remaining performance obligations to $11.35 billion, up 21% year-over-year, solidifying its position in AI-driven enterprise solutions.

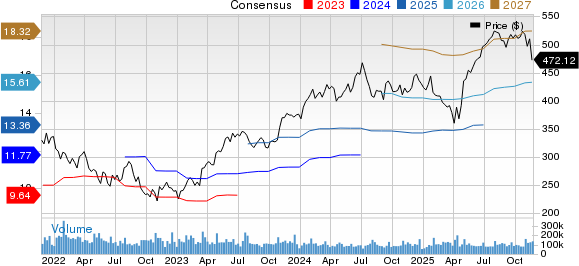

Year-to-date stock performance reflects a divergence, with Microsoft growing 12%, while ServiceNow experienced a decline of 23.3%. This contrasting trajectory presents potential investment opportunities as both companies navigate competitive cloud landscapes and AI advancements.

“`