Comparing Nebius Group and Microsoft: A Look at AI Infrastructure

Nebius Group N.V. (NBIS) is emerging in the AI infrastructure market, while Microsoft Corporation (MSFT) stands as a tech giant. Microsoft’s Azure cloud platform is the second-largest cloud service, following Amazon Web Services (AWS). Its investment in OpenAI has solidified Azure’s status as the premier platform for AI applications.

The swift growth of AI is reshaping the technology landscape, and AI infrastructure is becoming a critical competitive arena among tech firms. According to a report by IDC, investment in AI infrastructure is projected to exceed $200 billion by 2028. While both Microsoft and Nebius will benefit from this upward trend, the gains may not be equal. Thus, investors seeking opportunities in AI infrastructure must consider which stock stands out.

Let’s analyze the strengths and weaknesses of both companies to determine the better investment.

The Case for Nebius

Located in Amsterdam, Nebius is establishing itself as a focused AI infrastructure company. Its main offering, Nebius, is an AI-powered cloud platform tailored for demanding AI and machine learning (ML) workloads, utilizing both owned and colocation data center assets. The firm employs NVIDIA’s (NVDA) Reference Architecture to construct its AI cloud services. Additionally, NBIS develops full-stack AI infrastructure, including large-scale graphics processing units (GPUs), cloud platforms, and developer tools. Noteworthy products also comprise Toloka, an AI development platform; TripleTen, an educational technology service; and Avride, an autonomous vehicle initiative.

Nebius aims to enhance its data center presence and GPU deployments by 2025. The company is aggressively expanding within the United States, having launched its inaugural NVIDIA GPU cluster in Kansas City (5 MW initial phase) in November 2024. This facility will host thousands of NVIDIA’s Hopper GPUs, with the next-generation Blackwell platform expected in 2025. This setup is expandable to 40 MW, reducing latency for U.S. clients and enhancing the advantages of its AI-native cloud service. The firm is keen on establishing additional GPU clusters throughout the U.S. to meet the growing demand for top-quality AI infrastructure.

In March 2025, Nebius announced plans for a new data center in New Jersey with a total capacity of 300 MW, anticipated to finish its first phase by summer 2025. Concurrently, it revealed additional capacity at its existing colocation facility in Kansas City, expected to be operational by the end of Q2 2025. As it expands its AI infrastructure in Europe, Nebius is also working on a new colocation site in Keflavik, Iceland.

Given these advancements, Nebius is targeting a revenue run rate between $750 million and $1 billion for 2025. The company also holds a solid financial position, raising $700 million in a private placement with investors, including NVIDIA, Accel, and Orbis, in December 2024. At the close of Q4 2024, Nebius reported $2.4 billion in cash.

However, near-term growth may remain subdued for Nebius, as a challenging global macroeconomic environment presents hurdles. Rising lead times due to more selective customer behavior are likely to hinder revenue growth. Consequently, significant investments in capacity expansion may pressure margins in the short term.

The Case for Microsoft

In contrast to startup Nebius, Microsoft is a leading player in AI infrastructure, thanks to its Azure platform, which offers expansive global data center coverage. Azure’s availability in over 60 regions worldwide bolsters Microsoft’s competitive position in cloud computing.

Microsoft is also heavily investing in AI, including the development of custom AI chips like Azure Maia and Azure Cobalt.

The company’s multi-billion-dollar investment in OpenAI has significantly impacted the market. Microsoft is the exclusive cloud provider for OpenAI, hosting all workloads on the Azure platform. This partnership grants Azure priority access to cutting-edge AI models like GPT-4 Turbo and DALL·E. Microsoft is integrating OpenAI models directly into its services, including Copilot, Azure, and Bing, creating opportunities for cross-selling and revenue growth.

The increasing adoption of Azure’s enterprise capabilities, combined with Copilot across Microsoft 365, Dynamics 365, and Power Platform, bodes well for future performance. With Azure AI, Microsoft is establishing itself as a crucial AP server for the AI movement, enabling access to various models tailored to customer needs. Currently, the company has over 60,000 Azure AI customers.

In its last reported quarter, Microsoft Cloud revenues reached $40.9 billion, reflecting a 21% growth rate. Azure and other cloud services saw a 31% revenue increase, including a remarkable 157% year-over-year growth in AI services, significantly exceeding expectations despite ongoing higher demand than available capacity. Microsoft forecasts Azure revenue growth between 31% and 32% in the fiscal third quarter. Additionally, Microsoft’s cash reserves of $71.55 billion are substantially larger than Nebius’s funds.

Comparing Stock Performance: MSFT vs. NBIS

Both MSFT and NBIS have faced stock declines amid recent tech sell-offs, which were spurred by escalating trade tensions. Nevertheless, MSFT has only decreased by 3.1%, while NBIS has seen a sharper drop of 17.9%.

Image Source: Zacks Investment Research

Stock Valuation of MSFT & NBIS

In terms of valuation, both companies appear overvalued, with Microsoft receiving a Value Score of D and Nebius a Value Score of F.

Regarding Price-to-Book ratios, NBIS shares are trading at 1.52X compared to MSFT’s 9.13X.

Image Source:

NBIS and MSFT: A Comparative Analysis of Earnings Estimates

Revisions in Earnings Estimates for NBIS and MSFT

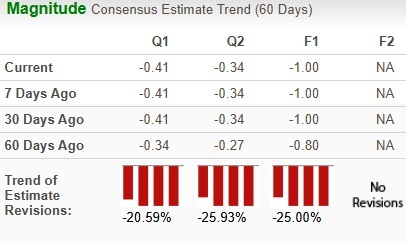

Analysts have made significant downward revisions to their earnings estimates for Nebius Group N.V. (NBIS). Conversely, the estimations for Microsoft Corporation (MSFT) have seen only slight downward adjustments.

Image Source: Zacks Investment Research

The differences in earnings expectations highlight a growing concern for NBIS amidst more stable projections for MSFT.

Image Source: Zacks Investment Research

Evaluating Investment Opportunities: NBIS vs. MSFT

In the evolving AI infrastructure market, NBIS is positioning itself uniquely, yet Microsoft remains a dominant player. For investors looking for a company with long-term growth potential in AI infrastructure, Microsoft stands out as the superior choice.

Microsoft holds a Zacks Rank of #3 (Hold), which indicates a stronger investment opportunity compared to Nebius, which is rated #4 (Sell).

Interested investors can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Exclusive Offer: Access Zacks’ Recommendations for Just $1

We’re serious about our offer.

A few years ago, we surprised our members with a promotional access period of 30 days to all our stock picks for just $1, with no further obligations.

Many have taken advantage of this offer, while others hesitated, questioning the validity. The purpose behind this initiative is to familiarize you with our various portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, among others, which achieved 256 positions with double- and triple-digit gains in 2024 alone.

see Stocks Now >>

Looking for the latest insights from Zacks Investment Research? You can now download the report on 7 Best Stocks for the Next 30 Days for free. Click to obtain this report.

In addition, explore our free analysis reports on:

Microsoft Corporation (MSFT) : Free Stock Analysis report

NVIDIA Corporation (NVDA) : Free Stock Analysis report

Nebius Group N.V. (NBIS) : Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.