Investors are increasingly focused on the growing artificial intelligence (AI) infrastructure market, projected to exceed $758 billion by 2029, according to an IDC report. Two companies, Nebius Group N.V. (NBIS) and Microsoft Corporation (MSFT), represent different investment strategies within this space: Nebius as a fast-growing pure play, and Microsoft as a dominant technology leader.

Nebius aims to ramp up its GPU capacity from a contracted 1 gigawatt to 2.5 gigawatts by 2026, bolstered by major contracts including a $3 billion deal with Meta and a $17.4–$19.4 billion agreement with Microsoft. The company expects annual recurring revenue to reach $7-$9 billion by 2026. In contrast, Microsoft plans to increase its AI capacity by over 80% this year and double its data center footprint over the next two years, with total revenues projected between $79.5 billion and $80.6 billion for Q2 of fiscal 2026, reflecting a growth of 14% to 16%.

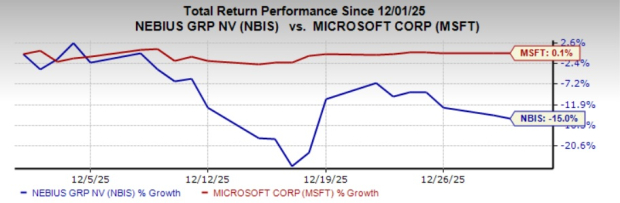

Recent stock performance shows that NBIS shares have dropped 15%, while MSFT shares have increased by 0.1%. Analysts have revised earnings estimates downward for Nebius, which currently carries a Zacks Rank #4 (Sell), while Microsoft holds a Zacks Rank #3 (Hold), suggesting it might be a more favorable investment at this time.