Netflix’s Strong Performance and Market Cap Highlights Streaming Dominance

Netflix, Inc. (NFLX), based in Los Gatos, California, is a global leader in subscription streaming and production services, active in nearly 190 countries. With a market capitalization of $412 billion, the company features a diverse portfolio of TV series, documentaries, feature films, and games across various genres and languages.

Market Position and Brand Strength

As a “mega-cap stock,” NFLX’s valuation clearly positions it among the top tier of public companies, greatly impacting the entertainment industry. The firm’s robust brand recognition, extensive library of content, and dedication to original programming—including award-winning films and series—distinguish it from the competition. Notably, Netflix original productions received 30 Emmy awards in 2024, underscoring its critical acclaim.

Recent Stock Performance

Active Investor: FREE newsletter going behind the headlines on the hottest stocks to uncover new trade ideas.

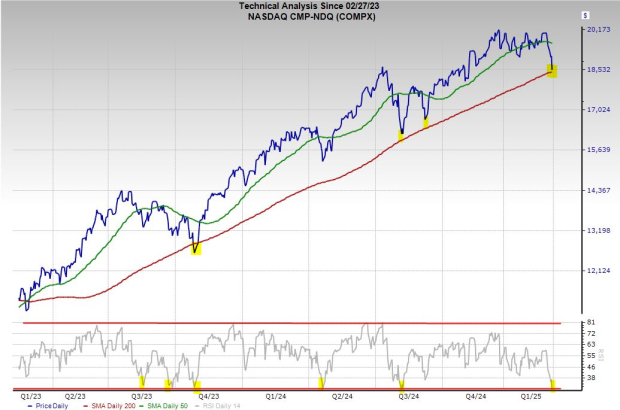

Despite its considerable market strength, NFLX shares have declined 9.5% from their 52-week high of $1,064.50, reached on February 14. However, in the last three months, NFLX stock increased by 9.8%, outperforming the Communication Services Select Sector SPDR ETF Fund (XLC), which gained 2.7% during the same period.

Looking at a broader time frame, NFLX shares are up 8.1% year-to-date (YTD) and have surged 60.1% over the past year. This performance also surpasses the XLC, which has recorded YTD gains of 3.8% and annual returns of 26.9%.

Trading Trends and Investor Confidence

Supporting this positive trend, NFLX has consistently traded above its 50-day moving average since August 2024, despite some price fluctuations. Additionally, the stock has remained above its 200-day moving average for the past year, indicating a strong market position.

NFLX’s market outperformance is attributed to its expansive scale, robust pricing power, improving profit margins, steady subscriber growth, and rising interest in ad-supported memberships. Innovations in live sports, advertising, and mobile gaming reinforce investor confidence, further illustrated by major events like the Logan Paul vs. Mike Tyson fight and NFL games, along with the recent rollout of its advertising technology platform in key regions, including the U.S. and Canada.

Q4 Results and Analyst Outlook

On January 21, NFLX announced its Q4 results, seeing a more than 9% rise in shares during the subsequent trading session. The company reported revenues of $10.2 billion, exceeding the analyst estimates of $10.1 billion. Its earnings per share (EPS) came in at $4.27, surpassing expectations of $4.20.

Although NFLX is competitive, Roku, Inc. (ROKU) has outperformed on a YTD basis, gaining 9.6%, but trails NFLX with a 27.7% return over the past 52 weeks.

Wall Street analysts maintain a moderately bullish outlook on NFLX. The stock currently holds a consensus “Moderate Buy” rating from 41 analysts, with an average price target of $1,074.92, suggesting a potential upside of 11.6% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy.

here.

More news from Barchart

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.