“`html

Netflix (NFLX) and Roku (ROKU) are shifting toward ad-supported business models to enhance growth as both companies show significant stock performance in 2025, with Netflix up over 30% and Roku recovering nearly 60% from 52-week lows. Netflix’s ad-supported tier has reached 94 million monthly active users globally, while Roku generated $1.1 billion from advertising and subscriptions in Q2 2025.

Netflix’s revenue hit $11.08 billion in Q2 2025, marking a 16% year-over-year increase, with a full-year revenue projection between $44.8 billion and $45.2 billion. In contrast, Roku’s net revenues for the same quarter were $1.11 billion, up 15%, but it faced losses of $105.96 million over the past year. Roku is also the leading streaming platform in North America, yet its reliance on hardware sales and smaller market capitalization presents vulnerabilities compared to Netflix’s substantial scale and profitability.

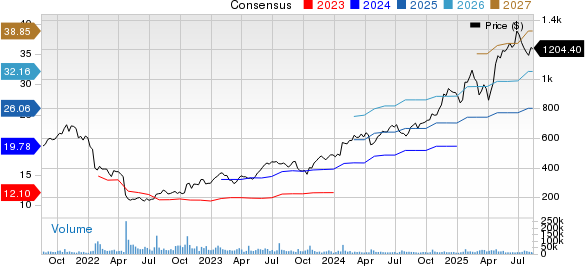

Netflix’s 2025 earnings estimate is $26.06 per share, indicating a 31.42% increase year-over-year, favoring it as a better investment opportunity over Roku, which has an earnings estimate of 12 cents per share following a loss of 89 cents in the previous year. Analysts rate Netflix with a Zacks Rank of #1 (Strong Buy) while Roku holds a #3 (Hold) rating.

“`