Netflix reported Q1 revenue growth of 13% to $10.54 billion, with operating income up 27% year over year. The company aims to double its revenues by 2030, targeting $43.5-$44.5 billion for the full year and $8 billion in free cash flow. Over 700 million viewers are engaged globally, with 55% of new subscribers in ad-supported markets opting for the advertising tier, projected to double in revenue by 2025.

In comparison, Warner Bros. Discovery disclosed Q1 revenues of $9 billion, down 10%, as it navigates a significant debt burden of $38 billion and restructures into two entities by mid-2026. The Max platform, featuring 122.3 million subscribers and available in 77 markets, continues to expand, although the financial profile presents challenges amid ongoing pressures in traditional media.

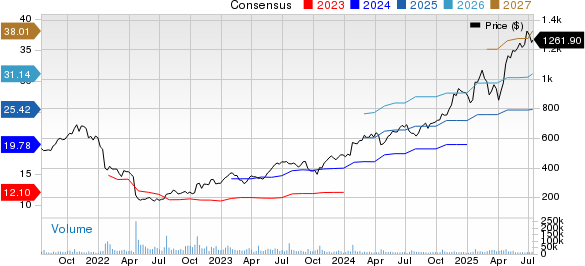

Overall, Netflix’s valuation reflects strong growth confidence with a forward price-to-sales ratio of 11.33x, while WBD’s is significantly lower at 0.77x. Year-to-date stock performance shows Netflix shares rising 41.6% compared to WBD’s 13.6%, signaling investor preference for Netflix amidst fears of WBD’s restructuring risks.