Wall Street Weighs in on Electric Vehicle Stocks: Nio, Li Auto, and Tesla

Electric vehicle (EV) manufacturers are currently navigating some obstacles, including decreasing demand influenced by economic factors, rising competition, and new tariffs on imports in some markets. In spite of these challenges, Wall Street analysts remain hopeful about select EV stocks that have demonstrated resilience and improved financial performance. Using TipRanks’ Stock Comparison Tool, we evaluate Nio (NIO), Li Auto (LI), and Tesla (TSLA) to identify which EV stock holds the most potential for growth, according to expert opinions.

Examining Nio (NYSE:NIO)

Nio, a Chinese EV manufacturer, has faced a significant drop in shares, losing over 42% in value this year, despite a rebound in September attributed to stimulus efforts in China. Nevertheless, concerns about the government’s future support measures, along with fierce competition, continue to affect investor confidence.

Despite these hurdles, Nio reported impressive delivery numbers in September. The company delivered 21,181 vehicles, showing a year-over-year increase of 35.4%. In Q3, total deliveries reached 61,855, a rise of 11.6%. Notably, September saw the introduction of the Onvo L60 model, with 832 units delivered shortly after its release on September 19.

In a recent development, Nio announced that Chinese investors will inject RMB3.3 billion into its subsidiary, Nio China, along with an additional RMB10 billion from the company itself. Daiwa analyst Kelvin Lau considered this cash infusion a positive step for operational support, maintaining a Buy rating on Nio stock as a result.

Nio’s Investment Outlook

HSBC analyst Yuqian Ding adjusted the price target for Nio to $7.20 from $7.90, while holding onto a Buy rating. The analyst expressed confidence in Nio’s growth in sales volumes and margins, given the strong performance of the NIO brand, the potential for increased sales of the ONVO L60 model, improved supply chain efficiencies, and better economies of scale.

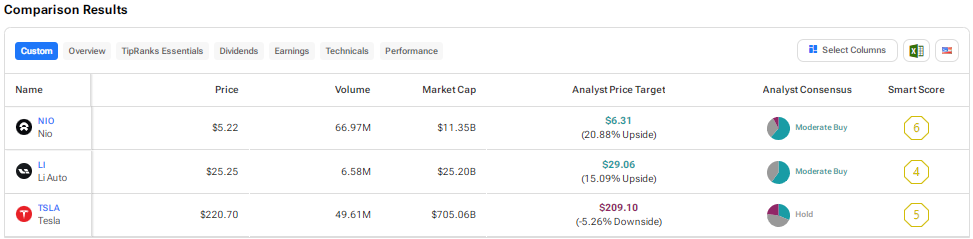

Overall, Nio carries a Moderate Buy consensus from Wall Street, which encompasses eight Buys, four Holds, and one Sell recommendation. The average price target sits at $6.31, indicating a potential upside of around 21%.

View additional NIO analyst ratings

Li Auto (NASDAQ:LI) in the Spotlight

Li Auto, another key player in the Chinese NEV market, saw its shares rise roughly 22% in the past month, driven by favorable news about government support and strong September sales. However, the stock is still down more than 32% for the year.

The company reported a significant 49% increase in September deliveries, totaling 53,709 vehicles. For Q3, Li Auto achieved 152,831 deliveries, marking a 45.4% year-over-year improvement, which it attributes to solid orders for its Li L series and Li MEGA models.

Nevertheless, Macquarie analyst Eugene Hsiao downgraded Li Auto from a Buy to a Hold rating while raising the price target from $25 to $33. He indicated that LI stock seems to be fully valued given the recent gains and lacks catalysts for new product launches in the latter half of 2024.

Li Auto’s Price Expectations

Li Auto enjoys a Moderate Buy consensus rating based on six Buys and four Holds. The average price target currently stands at $29.06, suggesting a potential upside of 15.1%.

View additional LI analyst ratings

Tesla (NASDAQ:TSLA) Faces Challenges

Tesla’s stock has declined over 11% this year amid concerns about its market share shrinking against new competitors and a drop in profit margins due to discounts. Investors were particularly disappointed after the company’s Q3 deliveries of 462,890 vehicles missed expectations, highlighting the pressures from economic conditions and strong competition in China.

The anticipation around Tesla’s robotaxi event also fell flat, according to Barclays analyst Dan Levy, who noted the event lacked substantial updates and failed to present immediate opportunities. Levy maintained a Hold rating with a $220 price target on TSLA.

Analysts are now keenly awaiting Tesla’s Q3 earnings report on October 23, with expectations of an 11% year-over-year decline in earnings per share, projected at $0.59. Revenue, however, is anticipated to increase by more than 9% to $25.47 billion. Analysts predict that price cuts and higher production costs will counterbalance revenue growth, likely impacting margins and EPS negatively.

Tesla’s Standing: Buy, Sell, or Hold?

Levy suggests that Tesla’s upcoming third-quarter results may prove beneficial in the short term by highlighting the company’s fundamentals. While he remains optimistic about TSLA’s long-term prospects, he prefers to adopt a wait-and-see approach given the immediate pressures facing the stock.

The consensus on Wall Street remains neutral for Tesla, with a Hold rating supported by 11 Buys, 16 Holds, and eight Sells. The average price target for TSLA is $207.83, indicating an expected potential decline of approximately 5.8%.

View additional TSLA analyst ratings

Final Thoughts

In summary, Wall Street appears cautiously optimistic about both Nio and Li Auto, while it remains neutral on Tesla. Analysts see greater growth potential for Nio stock compared to the others, thanks to its recovering sales and efforts to improve profit margins.

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.