“`html

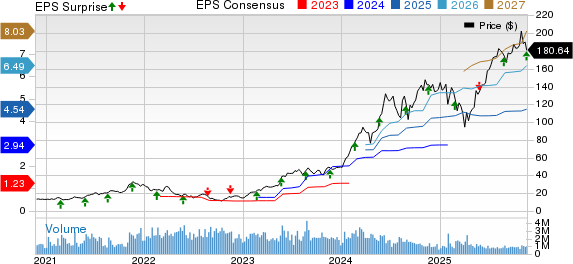

NVIDIA Corporation (NVDA) reported a 62% year-over-year revenue increase to $57 billion in the third quarter of fiscal 2026, with earnings per share (EPS) up 60% to $1.30. The company’s Data Center business generated $51.22 billion, contributing 89.8% of total sales and marking a 66% annual increase.

Taiwan Semiconductor Manufacturing Company (TSMC) saw a 41% revenue growth to $33.1 billion and a 39% EPS increase to $2.92 in the third quarter of 2025. The company plans to invest $40-42 billion in capital expenditures for 2025 to meet rising AI chip demand, with AI-related revenues tripling in 2024 and expected to double again in 2025.

NVIDIA’s growth outlook for fiscal 2026 indicates a 57.9% revenue surge, compared to TSMC’s projected 33.7% revenue growth. With NVIDIA holding a Zacks Rank #2 (Buy) and TSMC at rank #3 (Hold), NVIDIA appears to be the stronger investment choice in the AI chip market.

“`