AI Stock Showdown: Is NVIDIA or Palantir the Better Investment?

Artificial intelligence (AI) has catapulted NVIDIA Corporation NVDA and Palantir Technologies Inc. PLTR to Wall Street’s forefront. Last year, NVIDIA topped the Dow Jones Industrial Average, while Palantir led the S&P 500.

As the AI market enters an early growth phase, both companies show significant potential for future expansion. This raises the question: which stock stands out as the better AI investment today? Let’s explore.

The Case for Investing in NVIDIA

Recently, NVIDIA’s stock dipped due to a Chinese company launching a budget-friendly AI chatbot called DeepSeek. Nevertheless, the demand for NVIDIA’s chips is expected to rise as DeepSeek’s model promotes increased AI usage. Moreover, the robust interest in NVIDIA’s advanced Blackwell architecture is likely to boost revenues and stock prices.

Leading companies like Alphabet Inc. GOOGL and Microsoft Corporation MSFT are selecting Blackwell chips for their energy efficiency and enhanced AI capabilities. Even older models like NVIDIA’s Hopper chips continue to see steady demand, outpacing offerings from rivals like Intel Corporation INTC.

Despite potential disruption from DeepSeek, major players such as Microsoft and Meta Platforms, Inc. META are making large investments in NVIDIA’s technologies, collectively planning over $300 billion in AI infrastructure spending. This demonstrates NVIDIA’s strong growth prospects in the semiconductor sector.

Additionally, NVIDIA’s strong position in the graphics processing unit (GPU) market offers a competitive edge, which is projected to grow from $101.54 billion in 2025 to $1,414.39 billion by 2034, representing a compound annual growth rate (CAGR) of 13.8%, according to Precedence Research.

The Case for Investing in Palantir

Palantir is well-positioned in the expanding generative AI market, using its expertise in AI-driven process mining to capitalize on growth opportunities. The company plans to combine innovative AI with machine learning to accelerate development. An uptick in fourth-quarter revenues from commercial and government sectors suggests promising growth ahead.

Palantir’s fourth-quarter revenues hit $828 million, marking a 36% increase from the previous year. The company anticipates $3.75 billion in revenue by 2025, a 31% rise from last year. Its Artificial Intelligence Platform (AIP) is in high demand for its ability to automate tasks exceeding human capabilities.

Furthermore, Palantir has sales that were not recorded as revenues in the last quarter, suggesting further expansion potential.

Why NVIDIA Is a Smarter Investment Than Palantir Right Now

Despite the threat from DeepSeek, analysts predict NVIDIA’s stock could hit new highs in 2025, driven by the growing demand for its advanced chips. While Palantir’s advancements may also boost its stock, the long-term outlook for NVIDIA appears more favorable.

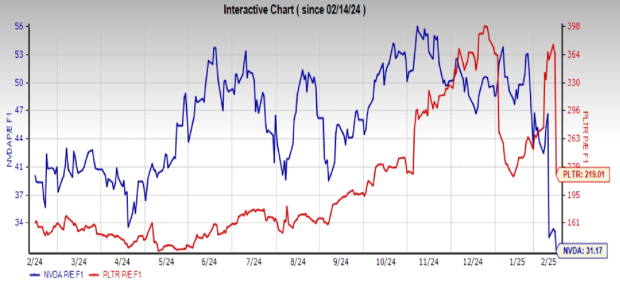

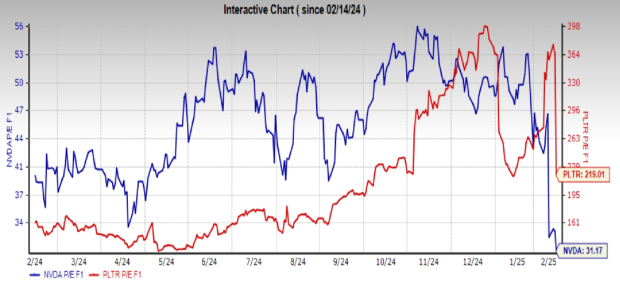

NVIDIA boasts a dominant position in the GPU market, and its diverse AI product offerings reduce investment risks compared to Palantir, which may struggle if AI capital decreases. From a financial perspective, NVIDIA’s stock is also more attractive with a price/earnings ratio of 31.17, significantly lower than Palantir’s ratio of 219.01.

Image Source: Zacks Investment Research

Both NVIDIA and Palantir carry a Zacks Rank #2 (Buy), demonstrating strong investment potential.

Expert Stock Recommendations from Zacks

Our research team has identified five stocks with the highest probability of doubling in value in the coming months. Among these, Director of Research Sheraz Mian has identified one standout stock poised for significant growth.

This stock is part of a fast-growing financial firm with over 50 million customers and an array of innovative solutions. While not all picks will succeed, this stock has the potential to exceed previous performers like Nano-X Imaging, which surged by +129.6% in less than nine months.

Curious about our top pick? Download the report to discover the seven best stocks for the next 30 days.

Intel Corporation (INTC): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Palantir Technologies Inc. (PLTR): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.