Key Points

-

Nvidia aims to become the leading AI infrastructure company.

-

Palantir’s U.S. commercial segment shows strong growth.

-

Palantir’s high valuation offers little margin for error.

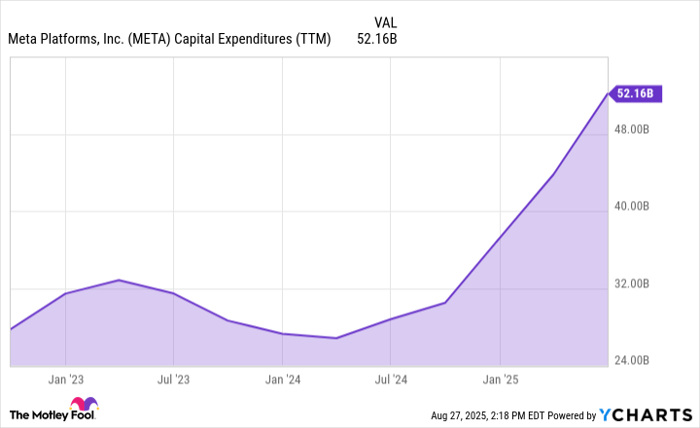

Nvidia (NASDAQ: NVDA) is positioning itself as a key player in AI infrastructure, with its data center revenue increasing 56% to $41.1 billion, representing 88% of its total revenue. The company expects to capture up to 70% of projected AI infrastructure spending, estimated to reach $3-4 trillion over the next five years.

Palantir (NASDAQ: PLTR), focusing on AI for data insights, achieved a 93% year-over-year revenue growth in its U.S. commercial segment, reaching $306 million. Although the company recorded its first billion-dollar quarter, it remains heavily reliant on U.S. government contracts, which make up 42% of its total revenue.

As of August 28, Nvidia has a forward P/E ratio of 41, while Palantir’s is significantly higher at 242, indicating a critical evaluation period for both companies amid the ongoing volatility in the AI market.