Nuclear energy stocks Oklo Inc. (OKLO) and NANO Nuclear Energy Inc. (NNE) are gaining attention as government support and investments in advanced nuclear technologies rise. By 2050, U.S. nuclear capacity has the potential to triple, positioning both companies for long-term growth in the industry.

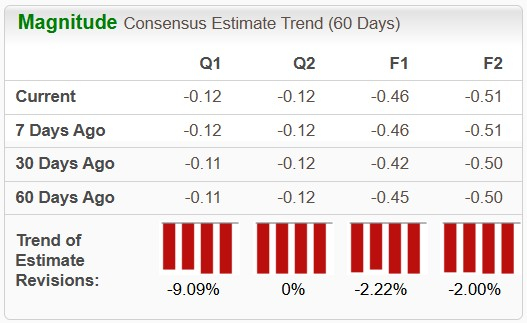

As of June 2025, Oklo’s financial stability includes $201 million in cash with no notable debt, while NNE reported $119 million in cash with a similar lack of debt. Both companies remain in the pre-revenue stage, with challenges including high operating expenses and lengthy regulatory timelines before commercial operations can commence. The Zacks Consensus Estimate for OKLO’s EPS in 2025 is a loss of 46 cents per share, contrasting with NNE’s estimated loss of $1.05 per share.

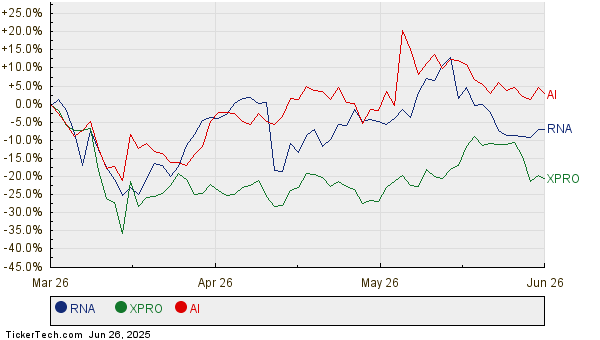

Stock performance shows OKLO increasing by 549.2% over the past year compared to NNE’s 119.9%. OKLO’s trailing 12-month Price/Book ratio is significantly higher at 28.72X compared to NNE’s 10.02X, indicating that while OKLO may attract growth-oriented investors, NNE presents a more attractive valuation for value-conscious traders.