Pan American Silver (PAAS) and First Majestic Silver (AG) are prominent players in the silver mining industry based in Vancouver, Canada. As of 2023, global silver prices have increased by 28%, while gold prices have risen by 29%, driven by strong demand across industries like solar energy and electronics. Silver is projected to face a supply deficit of 117.6 million ounces by 2025, marking the fifth consecutive year of deficits, favoring price increases. The Zacks Mining – Silver industry has surged 34.9% year-to-date, outpacing the S&P 500’s 1.2% gain.

Pan American Silver operates 12 mines across the Americas, with silver reserves of approximately 468 million ounces and 6.7 million ounces of gold. First Majestic focuses on silver and gold production, primarily in Mexico and the U.S., with proven reserves of around 86.8 million ounces of silver. In the first quarter of 2025, PAAS reported revenues of $773 million, reflecting a 28.6% year-over-year increase, while First Majestic’s revenues reached $243.9 million, up 130% from the previous year. PAAS plans a capital expenditure of $360-$385 million in fiscal 2025, while First Majestic’s target stands at $182 million.

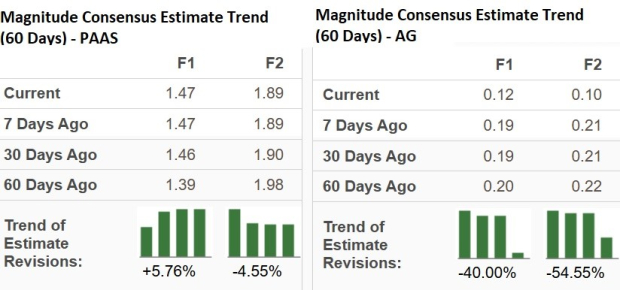

Analyst estimates for PAAS show an earnings growth of 86.1% in 2025, with an estimated $1.47 per share, while First Majestic’s estimates suggest a recovery from prior losses, forecasting 12 cents per share in 2025. PAAS has outperformed First Majestic in stock price growth over the past year, with a 40% increase compared to AG’s 30.7%. Furthermore, PAAS offers a higher dividend yield of 1.38% compared to AG’s 0.22%.