Palantir and UiPath Show Strong Business Growth

Palantir Technologies Inc. (PLTR) reported a 71% year-over-year growth in U.S. commercial revenues in Q1 2025, surpassing a $1 billion annual run rate for the first time. The adoption of its Artificial Intelligence Platform (AIP) was a key driver, with the total contract value in the commercial segment rising 239% year-over-year. Meanwhile, UiPath Inc. (PATH) generated $357 million in revenue for Q1 FY2026, reflecting a 6% year-over-year increase. Its annual recurring revenue rose by 12% to $1.69 billion, backed by strong customer retention rates between 110% and 115%.

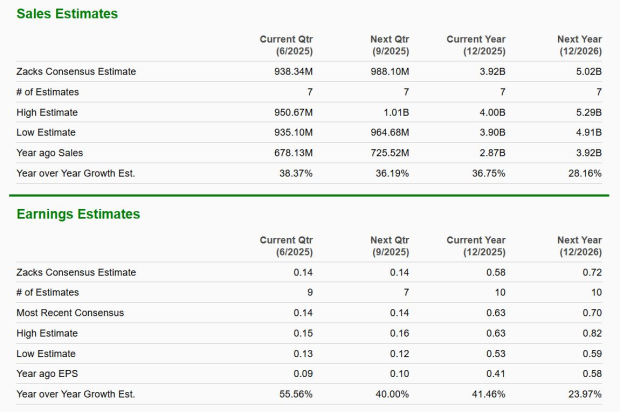

Valuation and Estimates

UiPath is trading at a forward sales multiple of 4.07X, which is below its 12-month median of 4.5X, while Palantir’s multiple stands at 72.9X, higher than its median of 46.76X. The Zacks Consensus Estimate forecasts 37% growth for Palantir’s 2025 sales and a 41% rise in earnings per share (EPS), while UiPath expects 8.5% sales growth and a 6% increase in EPS for the same period. Currently, UiPath holds a Zacks Rank #2 (Buy), whereas Palantir has a Zacks Rank #3 (Hold).