Stock Market’s Stellar Year: Will the Fateful Eight Sustain the Momentum in 2025?

The stock market saw an impressive surge in 2024, with the S&P 500 rising over 27%. This bull market marked its second consecutive year of growth. A significant portion of these gains came from the “Magnificent Seven,” a group of leading tech and artificial intelligence companies. With market capitalizations ranging from $1.5 trillion to $3.8 trillion, movements in these stocks can greatly influence the overall S&P 500 index. Almost all members of the Magnificent Seven saw substantial gains this year. As this group expands to the Fateful Eight, the question remains: can these stocks lead the market once more in 2025?

The Magnificent Seven Expands

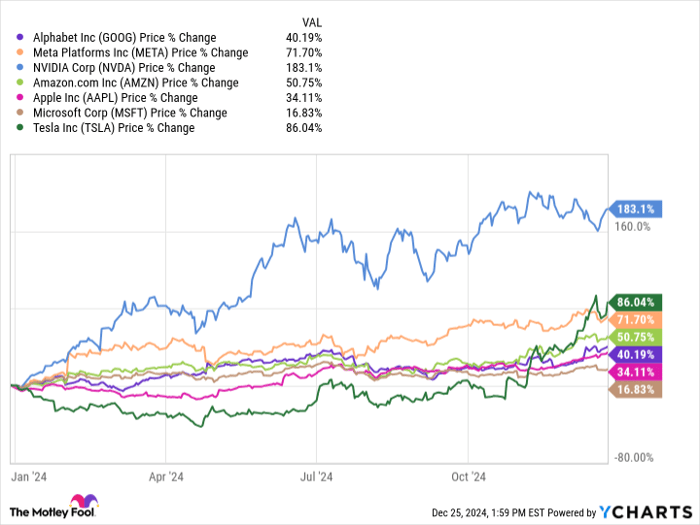

Bank of America analyst Michael Hartnett first identified the Magnificent Seven in 2023. This group showcases stocks that dominate in finance, market presence, and technological advancements. Here’s a look at how the Magnificent Seven performed through December 25, 2024:

Start Your Mornings Smarter! Get essential market updates directly in your inbox every weekday. Sign Up For Free »

GOOG data by YCharts.

All but Microsoft (NASDAQ: MSFT) outperformed the broader market, with the Magnificent Seven showing an average increase of close to 69%. This is particularly noteworthy since this group comprises about a third of the market’s value in the market-cap weighted S&P 500 and over 50% of the Nasdaq Composite value.

Recently, during an episode of the On The Tape podcast, financial analysts Dan Nathan, Guy Adami, Danny Moses, and Liz Young Thomas introduced the term “Fateful Eight,” which adds chip and software giant Broadcom (NASDAQ: AVGO) to the Magnificent Seven. Broadcom surpassed a $1 trillion market cap and saw its stock rise more than 45% in one month.

Insights on the Fateful Eight for 2025

Looking ahead, here are the forward earnings ratios for the Fateful Eight companies:

GOOG PE Ratio (Forward) data by YCharts.

The valuations for these stocks are quite high, with Tesla (NASDAQ: TSLA) standing out. Compared to Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) and Meta Platforms (NASDAQ: META), their valuations appear more reasonable. This has led many market experts to speculate on the possible performance of major indexes next year, given the Fateful Eight’s significant market weight. Despite these concerns, most Wall Street analysts remain optimistic about the market’s performance in 2025, albeit at a slower pace than seen in the past two years.

Over the last two years, the market has gained around 57%, making it unlikely for such a powerful performance to continue for a third straight year. However, it’s worth noting that during the late 90s tech boom, the market experienced five consecutive years of growth before the dot-com crash. With the potential of artificial intelligence on the rise, there are strong favorable conditions that could influence future growth.

Inflation and Treasury yields are expected to play significant roles in shaping these stocks’ performances in 2025. With the 10-year Treasury yield hovering near 4.6% (as of December 26), investors are understandably anxious about the potential for renewed inflation in 2025. The Federal Reserve now projects only two interest rate cuts in 2025, down from an earlier estimate of four. Additionally, there are concerns regarding how President-elect Donald Trump’s policies may impact the economy.

Nevertheless, positive data from the labor market or the Consumer Price Index could lead to more interest rate cuts, which would benefit stocks, especially in the tech sector that thrive in a “risk-on” environment. Other analysts believe the Fateful Eight may take on defensive characteristics amidst the current uncertainties.

While I anticipate some turbulence in 2025, I don’t expect Broadcom’s addition to drastically affect the Fateful Eight. The elevated valuations, challenging earnings comparisons, and potential economic obstacles from renewed inflation or a recession lead me to believe that the Fateful Eight might outperform the Magnificent Seven less next year. They could still end 2025 at higher values than now but likely won’t replicate the strong performances of 2024.

Your Opportunity Awaits

If you ever felt you missed an opportunity to invest in some of the best stocks, now is your chance to consider the following insights.

Our team of analysts occasionally issues a “Double Down” stock recommendation for companies they believe are set for substantial growth. If you have any concerns about missing your opportunity to invest, this might be the ideal time to jump in. Just take a look at the impressive figures:

- Nvidia: An investment of $1,000 back in 2009 would be worth $355,269 now!*

- Apple: A $1,000 investment in 2008 could grow to $48,404!*

- Netflix: Putting in $1,000 in 2004 would have turned into $489,434!*

Presently, we are issuing “Double Down” alerts for three notable companies, and chances like this don’t come around often.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 23, 2024

Bank of America is an advertising partner of Motley Fool Money. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former market development director at Facebook and the sister of Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board. Suzanne Frey, an executive at Alphabet, is also involved as a board member. Bram Berkowitz holds positions in Bank of America. The Motley Fool recommends Alphabet, Amazon, Apple, Bank of America, Meta Platforms, Microsoft, Nvidia, and Tesla, while also endorsing Broadcom and Nasdaq. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.