Pinterest, Inc. (PINS) reported a record 570 million global monthly active users in the first quarter of 2025, marking a 10% growth year-over-year. The company is leveraging advanced AI capabilities to generate 400 million predictions per second, enhancing user engagement and advertising conversion rates. As of March 31, 2025, Pinterest had $1.25 billion in cash and equivalents, with a current ratio of 8.41, indicating a strong liquidity position.

Snap Inc. (SNAP) reached over 900 million monthly active users in Q1 2025, particularly appealing to 75% of 13-34-year-olds in the U.S. The company introduced several new tools for creators, including a “Create a Video” template and Lens+, aimed at enhancing user engagement. At the end of Q1 2025, SNAP’s current ratio was 4.3, above the industry average of 2.38.

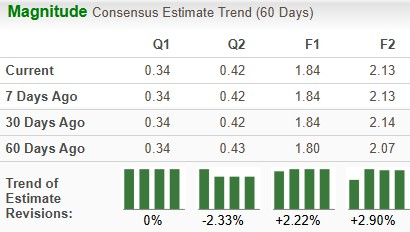

According to Zacks, Pinterest is estimated to achieve 13.8% growth in sales and 42.64% in EPS for 2025, while Snap expects 8.59% growth in sales but a 13.79% decline in EPS. Over the past year, PINS declined by 20.7% and SNAP by 47.8%, with SNAP trading at a lower price/sales ratio of 2.26 compared to PINS at 5.4.