PNC Financial Services Posts Mixed Performance Amid Market Challenges

Valued at a market cap of $71.1 billion, The PNC Financial Services Group, Inc. (PNC) is a diversified financial services company based in Pittsburgh, Pennsylvania. The company operates through three main segments: Retail Banking, Corporate & Institutional Banking, and the Asset Management Group.

Classified as a large-cap stock, PNC fits the criteria with a market value exceeding $10 billion. The American bank provides a variety of services including retail banking, residential mortgages, corporate and institutional banking, and asset management.

The financial services firm has declined 16.9% from its 52-week high of $216.26. In the last three months, PNC’s shares dropped 13.3%, underperforming the broader Dow Jones Industrials Average ($DOWI), which saw a decrease of 4.1% during the same timeframe.

Over a longer time frame, PNC is down 8% year-to-date, which is worse than the Dow’s slight decline. However, the firm has experienced a nearly 18% increase over the past 52 weeks, outperforming the Dow’s 9.6% gain in that period.

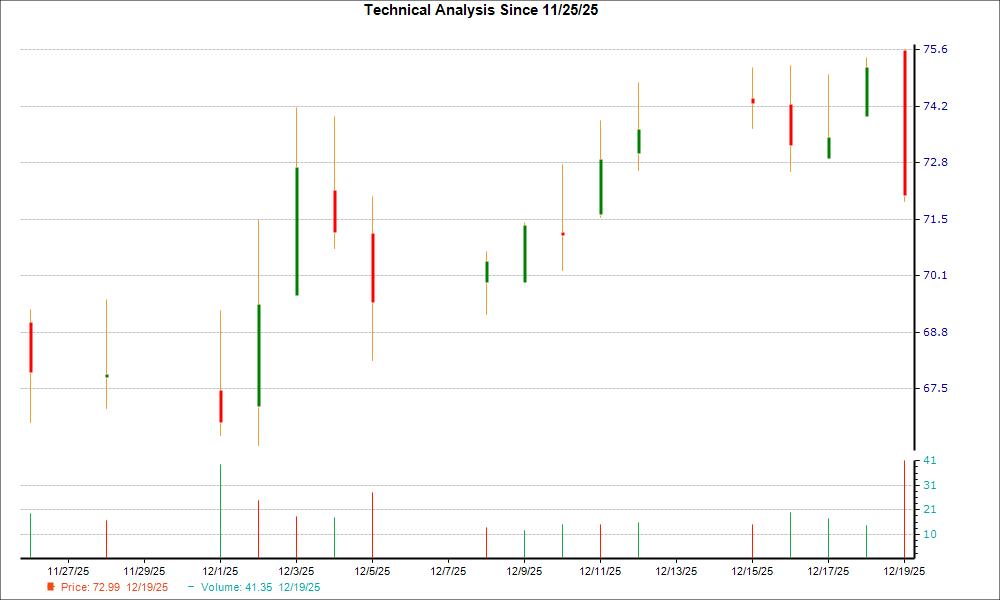

PNC has maintained trading above its 50-day and 200-day moving averages since last year. However, since mid-December, it has fallen below its 50-day moving average.

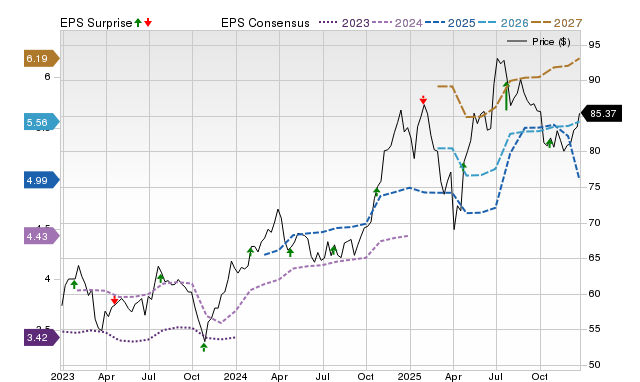

Despite exceeding Q4 2024 expectations with an adjusted EPS of $3.77 and revenue of $5.6 billion, shares dropped nearly 2% on January 16. Total loans decreased 1.5% sequentially to $316.5 billion, below the expected $318.8 billion, raising concerns about sluggish loan growth. Additionally, credit quality showed deterioration; non-performing loans rose 6.7% year-over-year to $2.3 billion, and net loan charge-offs surged 25% to $250 million, alarming investors.

Comparatively, Ames National Corporation (ATLO) has lagged behind PNC over the past year with marginal declines in its shares. Nonetheless, ATLO has managed a 13.1% increase year-to-date, outperforming PNC in this regard.

While PNC has outperformed the broader market in the past year, analysts remain cautiously optimistic about its outlook. PNC has a consensus “Moderate Buy” rating from 22 analysts and is trading below the mean price target of $220.07.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.