AMD and Broadcom: Analyzing Investment Potential Amid Market Challenges

Advanced Micro Devices (AMD) and Broadcom (AVGO) are critical players in the semiconductor industry, particularly in the realm of artificial intelligence (AI). The chips they produce are essential for operating Large Language Models, which are a foundational element of Generative AI (Gen AI). As AI applications continue to expand, both AMD and AVGO stand to benefit significantly. According to the Semiconductor Industry Association (SIA), semiconductor sales are predicted to climb 19.1% to reach $627.6 billion in 2024, with a double-digit growth rate expected in 2025.

Despite this promising outlook, AMD and Broadcom have faced declines in their stock prices this year amid a technological market sell-off, fueled by concerns over a potential recession. This uncertainty intensified following U.S. President Donald Trump’s imposition of tariffs on key trading partners such as China, Mexico, and Canada, raising fears of a trade war. Since these semiconductor firms depend on imported components from international markets, they are particularly susceptible to such geopolitical tensions.

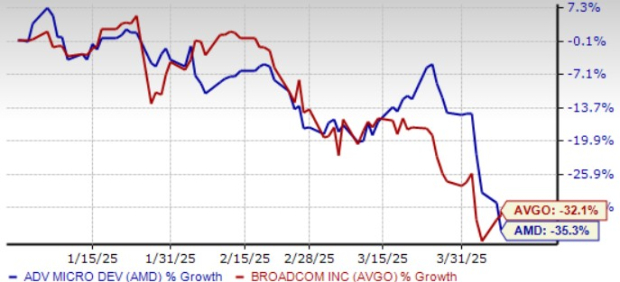

In 2023, AMD stocks have dropped 35.3% year to date, while Broadcom’s shares have fallen 32.1%.

Assessing AMD and AVGO Stock Performance

Image Source: Zacks Investment Research

With these factors in mind, a critical question arises: which company represents a better investment opportunity during these turbulent times? Let’s assess.

AMD’s Diversified Portfolio and Partner Network

AMD is making significant strides in the cloud data center and AI chip sectors, bolstered by its robust product range, including fifth-gen EPYC Turin processors and various Instinct accelerators paired with the ROCm software suite.

In 2024, AMD generated over $5 billion in data center AI revenue, propelled by the deployment of its MI300X in collaborations with Meta Platforms and Microsoft. The number of EPYC instances surged by 27%, exceeding 1,000, with hyperscalers like Amazon Web Services, Alibaba, Google, Microsoft, and Tencent introducing over 100 general-purpose AI instances just in the last quarter of 2024. Demand for AMD’s Instinct accelerators is up, with more than a dozen cloud service providers, including IBM and Digital Ocean, expecting further growth in 2025.

The company’s MI325X is currently in production, and its upcoming MI350 series, built on the CDNA 4 architecture, promises a 35-fold increase in AI computational performance compared to previous generations. AMD plans to ship samples to primary customers this quarter, while production acceleration is scheduled for mid-year. Furthermore, progress on the MI400 series is on track for a 2026 launch.

AMD’s aggressive acquisition strategy has bolstered its AI ecosystem, with recent buyouts of companies such as ZT Systems and Silo AI.

Broadcom’s Thriving ASIC Demand

Broadcom benefits from high demand for its application-specific integrated circuits (ASICs) tailored for AI and machine learning applications. These chips improve efficiency and performance, particularly crucial in training Generative AI models. Custom AI accelerators (referred to as XPUs) require intricate integration of computing, memory, and I/O capabilities to optimize performance while mitigating power consumption and costs.

AVGO is introducing the industry’s first 3-nanometer XPUs to market, with volume shipments projected for major customers in the latter half of fiscal 2025. Broadcom also envisions developing the world’s first 2-nanometer AI XPU, targeting clusters of 500,000 accelerators for hyperscale clients.

By 2027, Broadcom anticipates that its three main hyperscalers will implement one million XPU clusters in a single fabric, with the addressable market for XPUs and networking capable of reaching between $60 billion and $90 billion in fiscal 2027. Collaborations with notable partners like NVIDIA, Arista Networks, and DELL also enhance AVGO’s growth potential.

AVGO expects AI revenue for the second quarter of fiscal 2025 to surge 44% year-on-year to $4.4 billion, while semiconductor revenue is set to increase 17% year-on-year, reaching $14.9 billion.

Revised Earnings Estimates: Positive for AVGO, Stable for AMD

Current estimates from Zacks indicate that AVGO’s fiscal 2025 earnings are projected at $6.60 per share, reflecting a 35.52% increase from fiscal 2024 and a recent revision up by four cents.

Broadcom Inc. Stock Price and Consensus

Broadcom Inc. price-consensus-chart | Broadcom Inc. Quote

In contrast, AMD’s earnings consensus for 2025 remains at $4.59 per share, reflecting a predicted growth of 38.67% over 2024, unchanged over the past month.

Advanced Micro Devices, Inc. Stock Price and Consensus

Advanced Micro Devices, Inc. price-consensus-chart | Advanced Micro Devices, Inc. Quote

Both AVGO and AMD have surpassed Zacks Consensus estimates in their last four quarters. However, Broadcom has recorded an average surprise of 3.44%, outperforming AMD’s 2.32%, indicating stronger consistency in earnings performance.

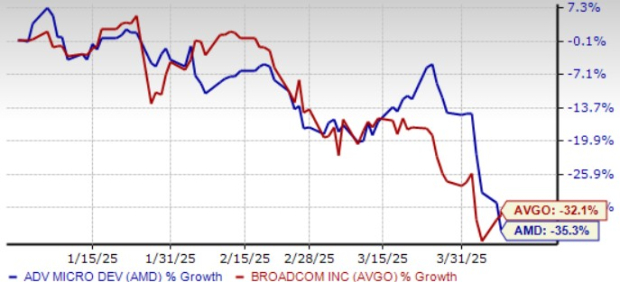

Valuation Analysis: AMD Appears More Affordable

From a valuation standpoint, both AMD and Broadcom show indicators of being overvalued, reflected by their Value Score of D. However, on a forward 12-month Price/Sales basis, AMD’s valuation at 3.77X is notably less than Broadcom’s at 10.99X.

Valuation Comparison of AMD and AVGO

Image Source: Zacks Investment Research

Conclusion: Broadcom is Currently the Stronger Buy

Broadcom’s expanding portfolio in AI, supported by a robust partner network, suggests promising top-line growth. In contrast, AMD faces challenges with diminishing prospects in its Gaming and Embedded segments and heightened competition within the Data Center sector from NVIDIA.

Presently, Broadcom holds a Zacks Rank of #1 (Strong Buy), while AMD maintains a Zacks Rank of #3 (Hold), indicating that Broadcom may be the preferred investment choice. For a comprehensive list of today’s Zacks #1 Rank stocks, please follow the provided link.

Discovering Stocks with Growth Potential

Five stocks, specifically chosen by a Zacks expert, are anticipated to surge by over 100% in 2024. Although not every selection will succeed, past recommendations have realized gains of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of the stocks featured in this report remain under the radar, presenting a unique early-entry opportunity.

For the latest stock recommendations, consider downloading the “7 Best Stocks for the Next 30 Days” report for free.

Advanced Micro Devices, Inc. (AMD): Free stock analysis report can be accessed here.

Broadcom Inc. (AVGO): Free stock analysis report can be accessed here.

This article originally aired on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.