GOOGL vs. RGTI: Analyzing Quantum Computing Investment Potential

Quantum computing is rapidly evolving and could generate enormous financial opportunities. Analysts predict the quantum computing market will expand from $1.3 billion in 2024 to $5.3 billion by 2029, growing at a compound annual growth rate (CAGR) of 32.7%, as reported by MarketsandMarkets. Fields like finance, life sciences, and chemistry are increasingly embracing these advanced technologies.

The unique ability of quantum computers to perform tasks more quickly than traditional computers has sparked renewed interest among investors. Unlike conventional bits that can either be zero or one, qubits can take on values in between. Nevertheless, it may take considerable time to fully commercialize quantum computers, as they tend to be error-prone. Consequently, investors often weigh options like Alphabet Inc. (GOOGL) against Rigetti Computing, Inc. (RGTI) for better stock prospects.

Comparing Futures: GOOGL vs. RGTI in Quantum Computing

Alphabet has made significant advancements in quantum computing since establishing Google Quantum AI in 2012. Their quantum chip, Willow, stands out for its ability to reduce errors and enhance large-scale quantum computing capabilities. Impressively, Willow mitigates errors faster than most supercomputers, solidifying its position as one of Alphabet’s premier innovations alongside YouTube, Google Search, and Google Cloud.

Conversely, Rigetti has launched its Quantum Cloud Services platform, which promises cost benefits for clients compared to traditional computing solutions. The demand for Rigetti’s Novera quantum processor, featuring 9 qubits, is increasing, and they plan to introduce a more robust 336-qubit system in the near future. They are also working on chip fabrication aimed at reducing noise, which should lead to revenue growth in both this year and next. Thus, both companies appear well-positioned in the quantum computing arena.

Investment Decision: Which Stock Is Superior?

Despite a generally optimistic outlook, Alphabet currently has an advantage over Rigetti. Thanks to its strong cloud computing position and lucrative digital advertising revenues, Alphabet has ample cash flow to support its research and development in quantum computing. In comparison, smaller companies like Rigetti may struggle financially, given the capital-intensive nature of their operations and inherent risks.

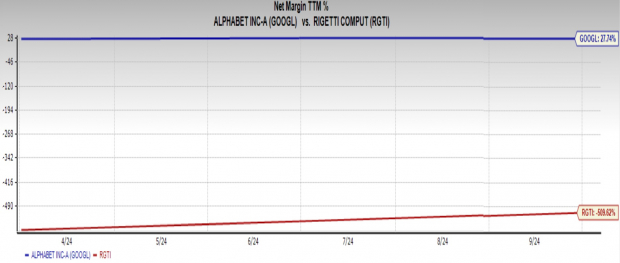

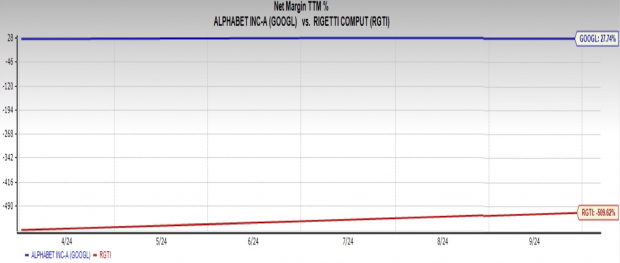

In quantum computing, financial stability is crucial for success. Alphabet maintains control over its operational expenses and generates consistent profits. In contrast, Rigetti’s costs have outpaced its revenues, resulting in a significant negative profit margin. Specifically, Alphabet’s net profit margin stands at 27.7%, whereas Rigetti operates at a startling negative 509.6%.

Image Source: Zacks Investment Research

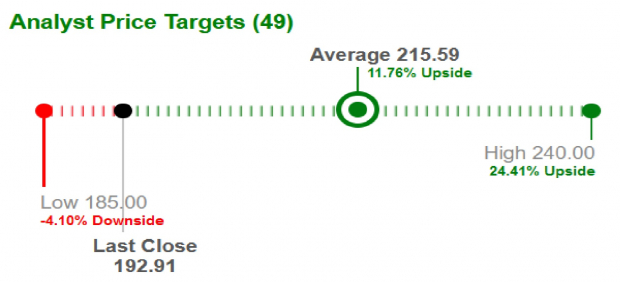

Reflecting this analysis, brokers have increased Alphabet’s short-term price target while lowering Rigetti’s, indicating that GOOGL is the stronger investment. The average short-term price target for GOOGL is $215.59, suggesting an 11.8% increase from its last closing price of $192.91.

Image Source: Zacks Investment Research

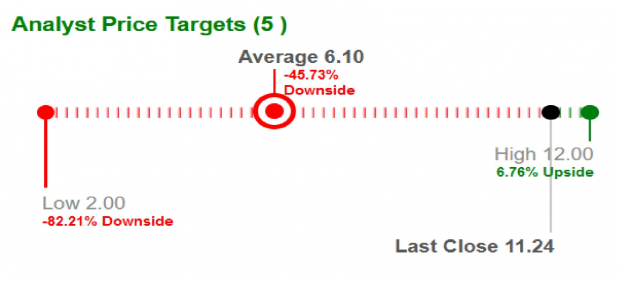

In contrast, RGTI’s average short-term price target is $6.10, representing a potential decline of 45.7% from its last closing price of $11.24.

Image Source: Zacks Investment Research

Currently, both Alphabet and Rigetti hold a Zacks Rank #3 (Hold) (read more: The Better Quantum Computing Stock to Buy Now: RGTI or IONQ).

To explore further investment options, you can view the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

5 Stocks Anticipated to Double

Five stocks have been highlighted by a Zacks expert as the top choices to potentially gain +100% or more in 2024. While not every recommendation may succeed, past selections have seen remarkable increases of +143.0%, +175.9%, +498.3%, and +673.0%.

The majority of these stocks remain below the radar of Wall Street, making this an opportune time to invest early.

Discover These 5 Potential Home Runs >>

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Rigetti Computing, Inc. (RGTI): Free Stock Analysis Report

Read the full article on Zacks.com here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.