IonQ, Inc. reported a net operating loss of $75.7 million in Q1 2023, up from $52.9 million in the same quarter last year. Despite this, the company held $588.3 million in cash and plans to raise $1 billion through an equity offering to fund its quantum computing initiatives. The quantum computing market is projected to grow to $100 billion by 2035, and IonQ is focusing on developing advanced quantum computers with trapped linear chain ions, achieving over 100 qubits with fewer errors.

NVIDIA Corporation achieved $130.5 billion in revenue for the 2025 fiscal year, a 114% increase year-over-year, with Q1 revenues at $44.1 billion, marking a 69% rise. The company reported an operating income of $21.6 billion for the same quarter. NVIDIA aims to integrate its GPUs and quantum processing units into a hybrid quantum system and is establishing research centers to develop large-scale quantum supercomputers.

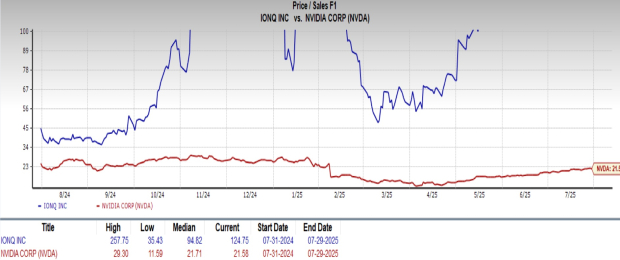

IonQ’s forward price-to-sales ratio stands at 124.75, while NVIDIA’s is significantly lower at 21.58, indicating IonQ may be overvalued. Both companies share Zacks Rank #3 (Hold), but NVIDIA is perceived to have better growth prospects and a more stable financial position in the quantum computing sector.