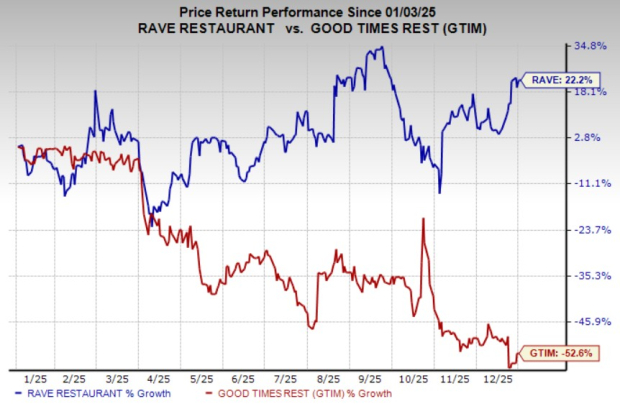

Rave Restaurant Group, Inc. (RAVE) and Good Times Restaurants Inc. (GTIM) are navigating a challenging restaurant landscape marked by cautious consumer spending and persistent cost pressures. RAVE operates an asset-light franchise model anchored by Pizza Inn and Pie Five, allowing for flexible expansion with lower capital investment. In contrast, GTIM uses a dual-brand strategy combining quick-service and full-service dining, which requires more operational resources and is sensitive to execution challenges. Over the past year, RAVE’s stock has gained 22.2%, while GTIM’s has declined by 52.6%.

Stock Performance & Valuation

As of recent evaluations, RAVE’s stock is trading at an enterprise value-to-sales (EV/S) ratio of 2.9X, above its five-year median of 1.9X, while GTIM stands at 0.1X, below its median of 0.2X. RAVE has outperformed GTIM significantly, with a 4.1% increase in the last three months compared to GTIM’s 26.2% drop.

Key Drivers

RAVE benefits from a flexible franchising model, steady royalty streams, and strong liquidity. Meanwhile, GTIM is focusing on fundamental improvements and marketing initiatives to stabilize sales as it undertakes an operational reset. Overall, the current environment favors RAVE’s scalable model and resilient cash flow structure compared to GTIM’s more volatile business approach.