“`html

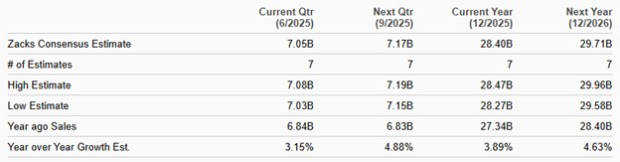

U.S. Bancorp (USB) and M&T Bank Corporation (MTB) are regional banks facing similar market pressures but employ different growth strategies. As of March 31, 2025, USB plans to grow total revenues by 3–5% from $27.6 billion reported in 2024, while MTB expects average loans and leases between $135 billion and $137 billion in 2025, with total deposits projected at $162–$164 billion.

Both banks reported strong financial positions, with USB holding $50 billion in cash and a long-term debt of $59.9 billion, while MTB had $22.8 billion in cash compared to $12.1 billion in borrowings. Each bank passed stress tests; USB plans to increase its dividend to 52 cents per share, while MTB announced a similar increase to $1.35 per share. Over the last three months, USB and MTB shares rose 19.9% and 20.9%, respectively, compared to an 18.8% increase in the industry.

In terms of valuation, USB trades at a forward P/E ratio of 10.33, below its five-year median, while MTB’s forward P/E stands at 11.42, above its median. Analysts see USB as a better choice for value investors due to its attractive valuation and diverse revenue sources.

“`