Ralph Lauren vs. GIII Apparel: A Comparative Outlook for Investors

Ralph Lauren Corporation (RL) and G-III Apparel Group, Ltd. (GIII) are key competitors in the textile and apparel industry, each with unique strategies to attract consumers and enhance market share. RL, widely recognized for quality and craftsmanship, appeals to a broad audience. In contrast, GIII functions as a nimble fashion house with an extensive brand portfolio and a focused licensing approach. The primary question for investors remains: which brand presents a better long-term value proposition?

Both companies are enhancing their omnichannel strategies to harmonize physical and digital platforms, addressing the increasing consumer shift to online shopping. E-commerce has become essential for businesses in the textile-apparel sector as consumer behaviors continue to evolve.

As both brands navigate unique challenges and opportunities within a transforming retail environment, this analysis will evaluate their strategies, financial performance, and market positioning to determine which brand is better positioned for sustained success.

The Case for Ralph Lauren

Ralph Lauren is currently demonstrating significant brand and product momentum, executing an effective long-term strategy across various markets and channels. The company’s initiatives include expanding product assortments, launching innovative items, and optimizing distribution to facilitate ongoing growth.

Ralph Lauren is on a successful pathway to meet and potentially exceed its sales and profit targets through the “Next Great Chapter: Accelerate Plan.” This strategic framework is focused on streamlining operations and leveraging technology to improve customer interactions and operational efficiencies.

The brand emphasizes higher-quality offerings, personalized promotions, prudent inventory management, and strategic location and channel expansion. Notably, Ralph Lauren has seen a substantial increase in its direct-to-consumer (DTC) segment, attracting nearly two million new customers. This growth stems from heightened investments in digital and omnichannel capabilities, including mobile and online shopping enhancements. As a result, the brand is drawing in a younger, high-value consumer base that is less sensitive to price, which is led to increased full-price sales and higher average retail prices.

Encouraged by these developments, Ralph Lauren anticipates a year-over-year constant-currency revenue growth of 6-7% for fiscal 2025, which surpasses the prior guidance range of 3-4%. This growth outlook includes projections of a 100-150 basis points negative impact from currency fluctuations. Management also expects the operating margin to grow by 120-160 basis points in constant currency, thanks to an anticipated gross margin improvement of 130-170 basis points.

However, macroeconomic uncertainties, particularly recent tariffs implemented by the U.S. government, pose considerable challenges. These factors highlight broader risks within the apparel retail sector, which remains sensitive to consumer spending fluctuations and overall economic conditions. Given that apparel purchases are largely discretionary, the industry is particularly vulnerable during periods of economic stress, inflation, or downturns.

The Case for G-III Apparel

In contrast, G-III Apparel has successfully pursued a transformative strategy by broadening its portfolio of owned brands and decreasing reliance on licensed products, which enhances control and profitability. The introduction of four new brands, including Donna Karan and Karl Lagerfeld, has notably fueled growth. This expansion is supported by increased digital investments and a strategic move into international markets.

In fiscal 2025, G-III reported strong fourth-quarter results characterized by solid revenue gains and a notable rise in profitability. Adjusted earnings per share increased significantly year over year, which reflects improved operational efficiency and robust pricing power.

The wholesale segment of G-III saw a meaningful increase in net sales, driven by solid performance from both owned brands and key licensed labels. Meanwhile, the retail segment, though smaller, also experienced healthy gains, underscoring the positive early impacts of G-III’s turnaround strategy.

To enhance its market position, G-III has invested heavily in digital infrastructure, improving its omnichannel capabilities. Sales from owned-brand digital platforms surged by over 20%, showcasing strong consumer engagement and successful expansion in e-commerce. Enhanced digital visibility has also been achieved through optimized product placements and partnerships with platforms like Amazon (AMZN) and Zalando.

Additionally, G-III is utilizing AI technologies to streamline its operations, improve supply chain transparency, and refine digital merchandising, primarily aimed at boosting profit margins. On the retail side, G-III executed a turnaround strategy in North America, cutting losses by 50% and contributing over $15 million in additional profitability, laying the groundwork for ongoing improvements into fiscal 2026.

Despite these advancements, G-III faces several headwinds impacting its fiscal 2026 outlook. The company provided cautious guidance, predicting a 1% decrease in net sales, projecting around $3.14 billion, with adjusted EPS anticipated between $4.15 and $4.25, down from $4.42 in fiscal 2025. Furthermore, adjusted EBITDA is expected to decline to $310-$315 million, as revenues in the particularly weak first quarter are forecasted to fall to $580 million from $609.7 million. These projections indicate a challenging transitional phase marked by demand uncertainties and potential pressure on earnings.

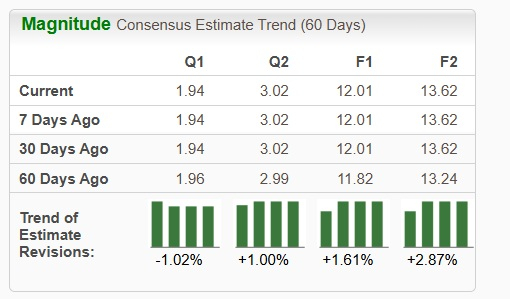

Comparative Consensus Estimates for RL and GIII

The Zacks Consensus Estimate for Ralph Lauren’s fiscal 2025 indicates an expected sales growth of 5.8% and a 16.5% increase in EPS, with estimates remaining stable over the past 30 days.

Image Source: Zacks Investment Research

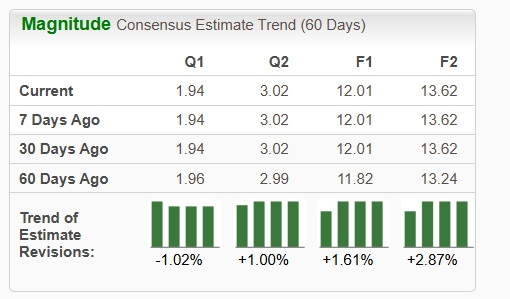

Conversely, the Zacks Consensus Estimate for G-III Apparel’s fiscal 2026 anticipates a year-over-year decline of 1.2% in sales and a 4.5% reduction in EPS. However, EPS estimates have adjusted upward slightly in the last 30 days.

Image Source: Zacks Investment Research

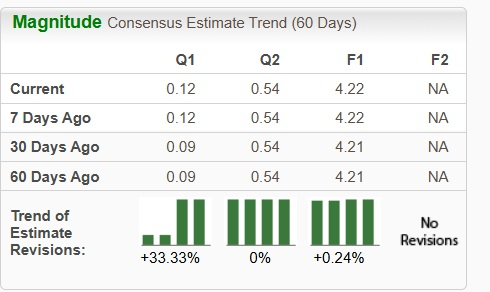

Price Performance and Valuation Analysis of RL and GIII

Over the past year, RL shares have outperformed, showing a total return of 13.8%, while G-III’s stock has declined by 13.8%.

Image Source: Zacks Investment Research

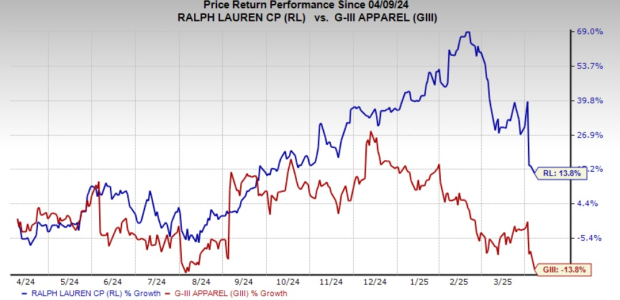

Ralph Lauren vs. G-III Apparel: Analyzing Investment Opportunities

Image Source: Zacks Investment Research

Current Valuation Snapshot

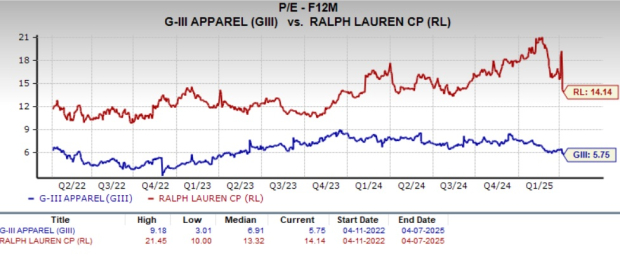

Ralph Lauren Corporation (RL) is trading at a forward price-to-earnings (P/E) multiple of 14.14, which exceeds its three-year median of 13.32. In contrast, G-III Apparel Group, Ltd. (GIII) has a forward P/E multiple of 5.75, sitting below its median of 6.91 over the same period.

The valuation of G-III stocks appears attractive. The company is actively expanding its owned brand portfolio and reducing reliance on licensed labels. Furthermore, its initiatives in sustainability, digital transformation, and omnichannel strategy present growth opportunities.

Although Ralph Lauren may seem expensive, this premium valuation reflects significant investments in digital transformation and product diversification. Such efforts position Ralph Lauren favorably for long-term growth, provided it maintains effective execution of its strategy.

Image Source: Zacks Investment Research

Conclusion

Both Ralph Lauren and G-III Apparel stand to benefit from evolving consumer trends. However, Ralph Lauren appears to be the more attractive long-term investment due to its strategic execution, strong brand equity, and promising financial outlook. The company is experiencing growth driven by premium product offerings, enhancing its direct-to-consumer and digital platforms. This strategy has successfully attracted a younger, higher-value customer base while also supporting pricing power and increasing average unit retail prices.

On the other hand, G-III Apparel has made notable strides in pivoting towards owned brands and improving its digital infrastructure. While G-III trades at a discount compared to peers and might appeal to value-focused investors, it faces challenges, including soft fiscal 2026 guidance and declining revenue expectations. These issues raise concerns about its turnaround strategy’s execution risk, suggesting growth potential is accompanied by volatility and uncertainty.

Therefore, for investors seeking stability and consistent growth tied to brand strength, Ralph Lauren represents the more dependable choice. Currently, RL holds a Zacks Rank of #1 (Strong Buy), whereas GIII has a Zacks Rank of #2 (Buy). To explore today’s Zacks #1 Rank stocks, click here.

Exclusive Offer on Zacks’ Market Insights

We’re not kidding.

Several years ago, we surprised our members by providing 30-day access to all of our stock picks for just $1, with no obligation to continue.

Many have taken advantage of this offer; others hesitated, suspecting a catch. The truth is we want you to experience our portfolio services such as Surprise Trader, Stocks Under $10, Technology Innovators, and more—having successfully closed 256 positions with double- and triple-digit gains in 2024 alone.

To see current stock recommendations from Zacks Investment Research, you can download our report on the 7 Best Stocks for the Next 30 Days. Click here to get your free report.

For further insights, here are free stock analyses:

Amazon.com, Inc. (AMZN): Free Stock Analysis report

Ralph Lauren Corporation (RL): Free Stock Analysis report

G-III Apparel Group, LTD. (GIII): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.