“`html

Mastercard Incorporated (MA) and Affirm Holdings, Inc. (AFRM) are competing to shape the landscape of short-term credit, particularly through the growing Buy Now, Pay Later (BNPL) trend. As of the third quarter of 2025, Mastercard reported net revenues of $5.4 billion, reflecting a 17% year-over-year growth, while Affirm posted $933 million in revenues, marking a 34% increase. As of September 30, 2025, Affirm has 24.1 million active consumers and 419,000 active merchants, highlighting its significant market presence.

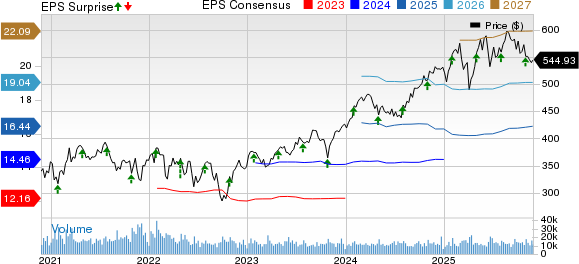

Mastercard, with a market capitalization of $489.4 billion, primarily supports BNPL solutions through partnerships rather than competing directly. In contrast, Affirm emphasizes transparency in short-term borrowing, notably enhancing its market integration with major retailers like Amazon and Shopify. While Mastercard’s earnings per share growth is projected at 12.6% for 2025, Affirm’s is expected to surge by 566.7%, showcasing its rapid growth potential.

Despite Mastercard’s strong financial position, it currently trades below its analyst price target suggesting a 21% upside. Affirm, however, trades significantly below its target with an attractive 37.7% potential upside, making it a more compelling prospect for investors seeking higher returns.

“`