“`html

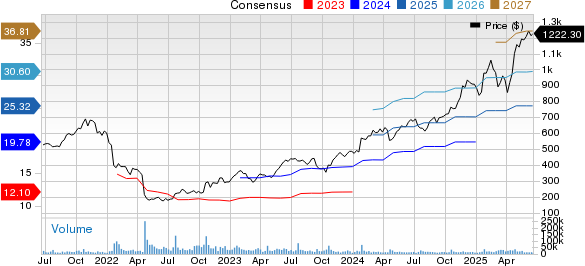

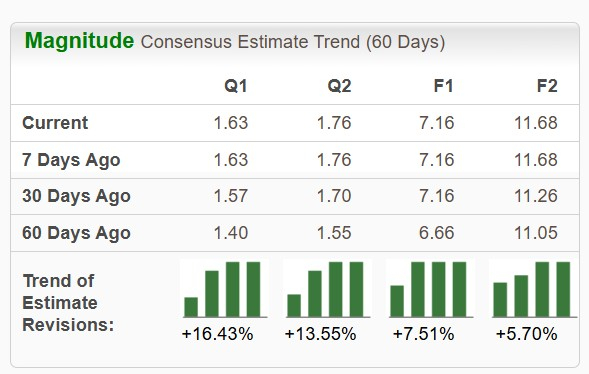

As of Q1 2025, Netflix (NFLX) reported earnings of $25.32 per share, marking a 27.69% year-over-year growth. The company aims to double its advertising revenues in 2025 through an ad-supported tier starting at $7.99. In comparison, Amazon (AMZN) announced earnings of $6.17 per share, an 11.57% increase from the previous year, while its AWS segment generated $29.3 billion in quarterly revenues, showing a 17% growth rate.

Year-to-date, Netflix shares have surged by 37.1%, while Amazon’s have declined by 3.1%. Netflix’s focused streaming approach offers clearer growth potential amidst the evolving entertainment landscape, whereas Amazon’s diversified model may limit direct impacts from streaming success due to its larger revenue contributions from AWS and retail.

Both companies currently hold a Zacks Rank of #3 (Hold), indicating potential for investors considering their respective positions in the market.

“`