Tesla Faces Stiff Competition from BYD in EV Market

Tesla (TSLA) has long been the face of the electric vehicle (EV) revolution. Since its initial public offering in 2010, this U.S. automaker has evolved into a global leader, recognized for its innovative design and dedicated customer base. However, the competitive landscape is changing rapidly. With a shift towards electric transportation, numerous automakers are now vying to challenge Tesla’s market position. Leading this charge is China’s BYD Co. Ltd. (BYDDY), a company that began as a battery manufacturer in 1995 and has now transformed into a major EV contender. With a strong background in battery technology and a growing international presence, BYD has positioned itself as Tesla’s most formidable rival to date.

In the fourth quarter of 2023, BYD briefly surpassed Tesla in EV sales, ending the full year just below its rival. The same trend was evident in 2024, as BYD reported over 416,000 battery electric vehicle (BEV) deliveries in the first quarter of 2025, outpacing Tesla’s 336,000 and securing the top spot for the second consecutive quarter. In contrast, Tesla witnessed declines in deliveries both year-over-year and quarter-over-quarter.

As competition intensifies, both companies are pushing the limits of EV development. However, BYD’s rapid expansion coupled with Tesla’s recent sales decline has narrowed the gap significantly. As this high-stakes competition for EV supremacy unfolds, investors are left wondering where to place their bets. Let’s explore the details.

Examining Tesla’s Position

Tesla is encountering increased pressure in its core EV segment. Sales are dropping in key markets such as the U.S., Europe, and China, as the brand’s once unassailable allure begins to wane. Concerns are mounting regarding CEO Elon Musk’s commitment to Tesla as he becomes more involved in the Department of Government Efficiency amidst the company’s struggle with reduced demand and heightened competition. While Musk expects some growth in vehicle sales this year, he has decreased his earlier forecast of 20–30% growth. Compounding these issues, Tesla’s automotive margins are narrowing as the automaker continues to implement price discounts and incentives to stimulate sales. Furthermore, delays in the rollout of Tesla’s highly anticipated affordable model are contributing to negative sentiment.

On a positive note, Tesla’s Energy Generation and Storage division is gaining momentum. Products such as the Megapack and Powerwall have been well-received, contributing to a 113% increase in energy storage deployments year-over-year in 2024. Musk anticipates at least a 50% growth in this segment in 2025. Additionally, Tesla’s charging infrastructure is thriving. The company recently claimed its in-house 4680 battery production has become more cost-effective than relying on external suppliers—a significant milestone for the automaker.

Looking ahead, Tesla is heavily invested in its autonomous driving initiative. It plans to introduce unsupervised Full Self-Driving (FSD) in Austin this June and has secured initial approvals necessary to launch its long-anticipated robotaxi service in California. Progress in FSD approvals and robotaxi development will be critical, especially with no further delays anticipated.

Financially, Tesla remains stable, boasting high liquidity and low debt levels. Its long-term debt-to-capitalization ratio is around 7%, and the company enjoys a robust interest coverage ratio of 27.7.

An Overview of BYD

BYD has emerged as a key player in China’s electric vehicle market, capturing approximately one-third of the new energy vehicle (NEV) sector. The company commands the largest EV market share in China, thanks to its efficient, vertically integrated business model. By controlling nearly every facet of its supply chain—from batteries and semiconductors to vehicle assembly—BYD can maintain low costs and efficient operations, which is essential in today’s price-sensitive EV market.

The company manufactures lithium-iron phosphate batteries under its Blade Battery brand. Its latest innovation, the “Super e-Platform,” promises significant improvements in range and charging speed. BYD asserts its batteries can achieve up to 400 kilometers (approximately 249 miles) of range with just five minutes of charging—potentially transforming the usability of EVs. The company offers a diverse vehicle lineup, catering to various consumers from budget-friendly models like the Seagull to premium options under the Yangwang brand. Its hybrids and EVs, including the Song and Qin series, continue to drive strong sales at home. Additionally, BYD is progressing with its new “God’s Eye” autonomous driving system, which features advanced safety capabilities at a competitive price point.

Internationally, BYD is rapidly expanding, establishing factories in Brazil, Thailand, Hungary, and Turkey, while enhancing its retail presence in Germany and Australia. The company aims to double its overseas sales to over 800,000 units by 2025. Nonetheless, increasing regulatory risks—particularly in Europe, where the EU is examining Chinese EV subsidies—pose potential challenges.

In 2024, BYD reported a net profit rise of 34% to RMB 40.25 billion, while revenues increased by 29% to a record RMB 777.1 billion (around $107 billion).

Forecasts for TSLA & BYDDY

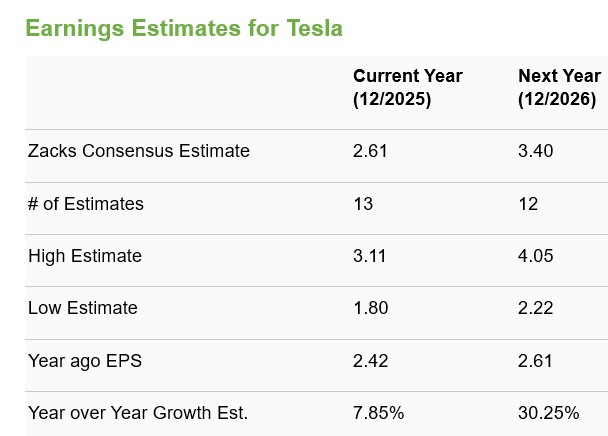

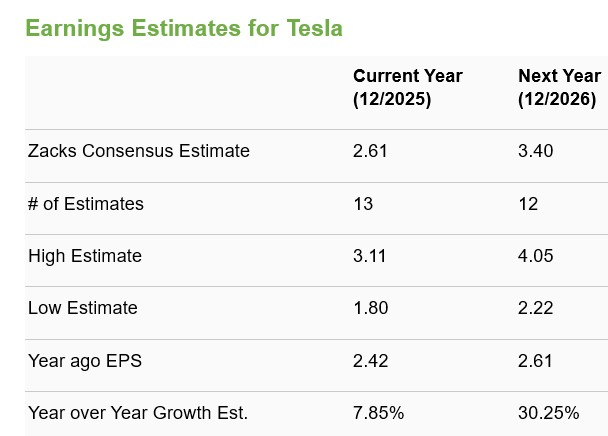

The Zacks Consensus Estimate for both Tesla and BYD’s 2025 earnings indicates year-over-year improvement. However, the consensus estimate for TSLA has decreased over the past 30 days, whereas BYD’s consensus mark has trended upward.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Evaluating BYD’s Valuation Compared to Tesla

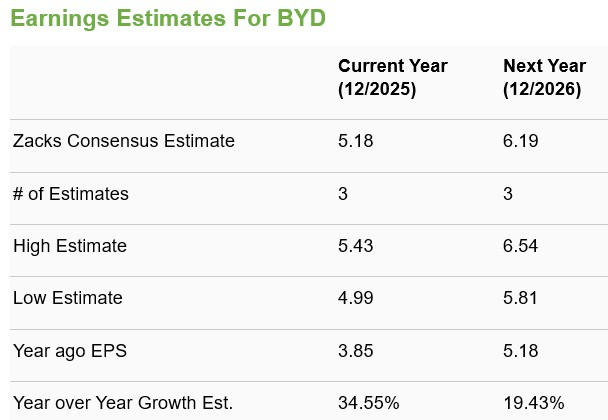

Tesla is currently trading at a forward sales multiple of 7.08X, which is higher than its average of 6.62X over the past two years. The company has a Value Score of F. Conversely, BYD holds a Value Score of B, with a forward sales multiple of 0.95X.

Image Source: Zacks Investment Research

Final Thoughts

In the current market, BYD seems to have a stronger position than Tesla. The company’s solid domestic leadership, growing international outreach, cost efficiency from vertical integration, superior battery technology, and advancements in autonomous driving make it an appealing option for investors. Additionally, BYD offers a more attractive valuation with optimistic earnings projections, indicating further growth potential.

In contrast, Tesla faces challenges stemming from declining sales, shrinking margins, and leadership distractions. While its non-automotive segments are performing well, they contribute only a small fraction of total revenues. Tesla’s high valuation and downward revisions in estimates further cloud investor confidence.

As of now, BYD holds a Zacks Rank of #3 (Hold), while Tesla is rated #4 (Sell).

You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Expert Identifies “Stock With Highest Doubling Potential”

Our expert team has identified the top five stocks most likely to gain +100% or more in the coming months. Among these, Director of Research Sheraz Mian highlights a particular stock poised for significant growth.

This top pick is recognized for its innovative financial solutions, boasting a rapidly expanding customer base (over 50 million) and a diverse range of offerings. This stock has considerable upside potential. While not every selection is guaranteed to succeed, this one could significantly outperform past Zacks’ Stocks Set to Double, such as Nano-X Imaging, which surged +129.6% in just over nine months.

Free: see Our Top Stock And Four Runners Up

Want the latest insights from Zacks Investment Research? Download the 7 Best Stocks for the Next 30 Days today. Click to access this free report.

Tesla, Inc. (TSLA): Free Stock Analysis report

BYD Co., Ltd. (BYDDY): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein belong to the author and may not reflect those of Nasdaq, Inc.