The global autonomous vehicle (AV) market is projected to grow from approximately $106 billion in 2021 to over $2.3 trillion by 2030, drawing considerable interest from companies like China’s Baidu (BIDU) and Uber Technologies (UBER). Baidu, a key player in the robotaxi sector, reports extensive operations across more than 20 cities in China, including fully driverless services in Beijing, Wuhan, and Shenzhen. Internationally, it is expanding into Dubai and Switzerland. Recently, Baidu entered a partnership with Uber, allowing for the integration of its driverless vehicles into Uber’s platform in select Asian and Middle Eastern markets.

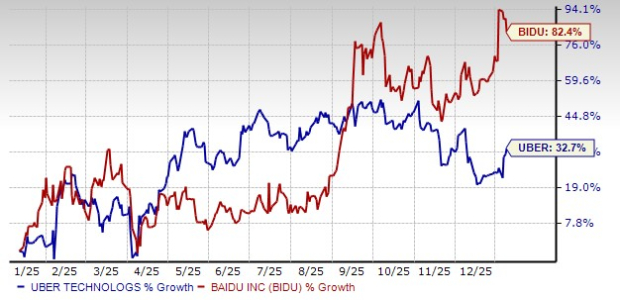

Uber is adopting a hybrid AV strategy, leveraging partnerships with external technology developers to avoid the heavy costs of in-house development. After selling its autonomous division in 2020, Uber continues to integrate AV capabilities, focusing on the suburban market while utilizing its established ride-hailing network to facilitate quick scalability. Over the past year, Uber’s shares have risen over 32%, while Baidu’s shares have surged more than 82%. Currently, Baidu holds a more favorable valuation with a forward price-to-sales ratio of 2.45 compared to Uber’s 3.01.

Baidu’s outlook for 2026 appears brighter, with recent earnings estimates seeing upward revisions, contrasting with modest adjustments for Uber. As both companies navigate through their AV strategies, Baidu’s rapid advancements and collaborations position it as a potentially stronger investment compared to Uber.