Investors Eye Domestic Steel Amid Tariff Policies

President Trump’s 25% tariff on imported steel has sparked a surge of interest in domestic steel companies, particularly Nucor NUE and United States Steel X.

With anticipated increases in steel production, investors are now evaluating which stock might prove the better investment.

A Shift in Steel Policy

Trump’s promises to protect the American steel industry have led to a notable rise in stock prices for both United States Steel and Nucor this week.

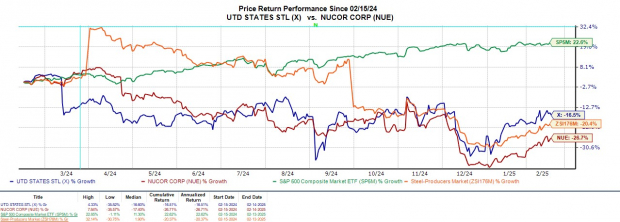

As of February, stock prices for X and NUE have increased by +4% and +6%, respectively. However, it’s important to note that over the past year, both companies have underperformed compared to the broader market.

Image Source: Zacks Investment Research

Future Projections for X and NUE

According to estimates from Zacks, United States Steel is projected to see a 2% increase in total sales for fiscal year 2025, with expectations for a further 6% growth in FY26, reaching $17.07 billion. However, annual earnings are forecasted to drop by 19% in FY25 to $1.73 per share, a decline from $2.14 in 2024.

In 2026, earnings per share (EPS) for United States Steel are expected to rebound significantly, soaring by 98% to $3.42. However, estimates for FY25 and FY26 have recently declined by 26% and 8%, respectively, after the company issued a lower-than-expected guidance in its Q4 report last Tuesday, despite reporting better-than-forecasted earnings.

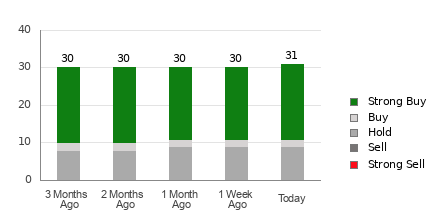

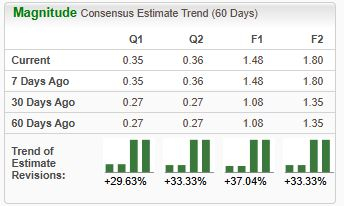

Image Source: Zacks Investment Research

For Nucor, the outlook looks mixed. Total sales are expected to shrink by 1% in FY25 but are forecasted to bounce back by 6% in FY26, reaching $32.26 billion. Earnings per share for Nucor might drop 14% this year, but are expected to rise by 43% to $10.99 in FY26. Additionally, EPS estimates for FY25 have declined by 8% recently, and FY26 estimates are down by 2%.

Image Source: Zacks Investment Research

Valuation Insights: Comparing X and NUE

Nucor’s current valuation seems appealing, trading at 17.2X forward earnings, closer to the industry average of 12.3X. Meanwhile, United States Steel trades at a higher valuation of 19.4X, despite a less favorable earnings outlook when compared to Nucor.

Image Source: Zacks Investment Research

Conclusion

United States Steel’s performance appears to rely heavily on protective policies, currently holding a Zacks Rank #5 (Strong Sell) amid troubling trends in earnings estimates. Conversely, Nucor’s earnings potential remains promising, resulting in a Zacks Rank #3 (Hold), suggesting that better buying options may still emerge.

7 Promising Stocks to Watch in the Coming Weeks

Recently released: Experts have identified 7 strong stock picks from a total of 220 Zacks Rank #1 Strong Buys that they believe are “Most Likely for Early Price Increases.”

Since 1988, this full list has consistently outperformed the market, with an average yearly gain of +24.3%. Investors should take note of these 7 carefully selected stocks.

United States Steel Corporation (X): Free Stock Analysis Report

Nucor Corporation (NUE): Free Stock Analysis Report

To read the full article on Zacks.com, click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.